Last year, a colleague of mine—IT job, decent salary—confessed something during lunch.

“Every month, salary comes. Every month, money disappears.”

No debt.

No luxury lifestyle.

Still zero savings.

That’s when I introduced him to the savings challenge india concept—specifically, the 26-week savings challenge india.

No pressure.

No sacrifice drama.

Just one simple habit every week.

Six months later, he sent me a screenshot.

His savings account showed ₹78,000.

Not from a bonus.

Not from luck.

Just from consistency.

If saving money feels heavy, confusing, or impossible right now—this guide is for you.

Let’s do this the Indian way. Slowly. Practically. Sustainably.

26-Week Savings Challenge India

Understanding the 26-Week Savings Challenge India

Let’s break this down in plain language.

The 26-Week Savings Challenge India is a simple method where you save a fixed (or increasing) amount every week for 26 weeks—roughly six months.

No spreadsheets.

No finance jargon.

No guilt.

Think of it like this:

Instead of trying to save a big amount monthly (which often fails), you save small weekly amounts that grow slowly.

Most people don’t realize this:

👉 Weekly savings feel lighter than monthly savings.

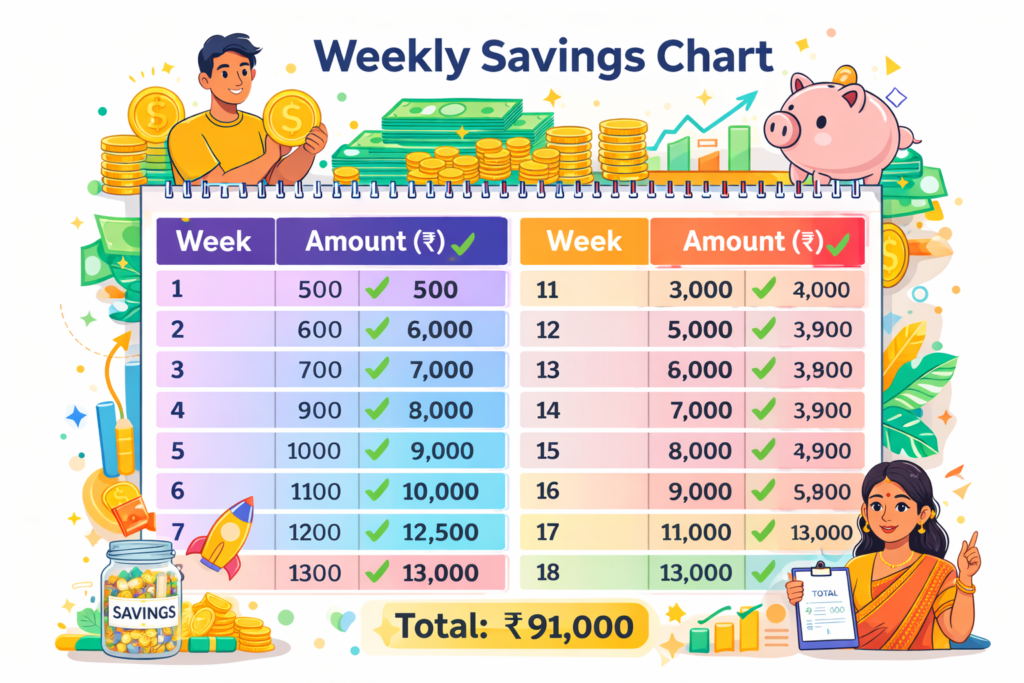

Two Popular Versions in India

Option 1: Increasing Weekly Method (Classic)

| Week | Amount (₹) |

|---|---|

| 1 | 500 |

| 13 | 3,000 |

| 26 | 13,000 |

| Total | ₹91,000+ |

Option 2: Fixed Weekly Method (Beginner-Friendly)

Save ₹1,000 per week × 26 weeks

Total: ₹26,000

Here’s the truth…

Both work.

The best one is the one you can stick to.

Why the 26-Week Savings Challenge Matters (Indian Reality)

Think about this…

In India:

• Expenses are unpredictable

• Family responsibilities come first

• EMIs eat savings silently

• Festivals arrive without warning

I’ve seen families earning ₹30,000 save more than families earning ₹1 lakh.

The difference?

System, not salary.

Real Indian Benefits

✔ Works for salaried professionals

✔ Works for students & freelancers

✔ Works for joint families

✔ No market risk

✔ No lock-in fear

This challenge respects Indian realities—school fees, rent, groceries, parents, festivals.

Step-by-Step Guide (Zero Confusion)

Step 1: Decide Your Weekly Comfort Amount

Ask yourself:

“What amount can I save weekly without stress?”

Not impressively.

Not aggressively.

Comfortably.

₹300? ₹500? ₹1,000? All valid.

Step 2: Choose Where to Keep the Money

Best Indian options:

• Separate savings account

• Recurring Deposit (RD)

• Liquid mutual fund

⚠️ Never mix this with your main salary account.

Step 3: Automate or Manual?

| Method | Best For |

|---|---|

| Auto-debit | Salaried |

| Manual transfer | Students / freelancers |

Automation beats motivation.

Step 4: Track Weekly (2 Minutes Only)

Use:

• Notes app

• Google Sheet

• ET Money / Fi / Jupiter app

Seeing progress builds confidence.

Tips, Mistakes & Pro Secrets

Common Mistakes Indians Make

❌ Starting too big

❌ Using credit card to “save”

❌ Breaking the challenge for shopping

❌ Not involving family

Pro Secrets That Actually Work

✅ Start smaller than you think

✅ Increase only after 4 weeks

✅ Treat savings like rent

✅ Celebrate milestones (Week 10, 20)

Think about this…

Saving should feel boring, not heroic.

Comparison – Best Ways to Do the Challenge

| Method | Risk | Liquidity | Best For |

|---|---|---|---|

| Savings Account | None | High | Beginners |

| RD | None | Medium | Salaried |

| Liquid Fund | Low | High | Disciplined users |

| Cash | Risky | High | Not recommended |

Real-Life Indian Stories

Story 1: College Student (Chennai)

An engineering student saved ₹300 weekly from internship money.

After 6 months—₹8,000.

First emergency fund.

First confidence.

Story 2: Working Couple (Bangalore)

Used a joint RD.

Saved ₹52,000.

Used it for a family trip—no loans.

Memories > EMIs.

Story 3: Homemaker (Coimbatore)

Saved from grocery budgeting.

₹500 per week.

Used for gold savings.

Silent discipline. Powerful outcome.

Tools, Apps & Resources

These tools genuinely make the challenge easier:

Best Indian Apps

| App | Why It Helps | Watch-out |

|---|---|---|

| Groww | Simple UI, RDs & funds | Over-invest temptation |

| ET Money | Goal tracking | Needs discipline |

| Fi Money | Smart insights | App-based only |

| Jupiter | Weekly nudges | Limited branches |

| Paytm Money | Easy RDs | Notifications overload |

This is what helped me personally:

👉 Separate app + auto-debit = no excuses.

Yes. No market dependency if done via savings/RD.

Final Thoughts

If you’ve read this far, I want to tell you something honestly.

You’re not bad with money.

You were just never given a simple system.

The 26-Week Savings Challenge India (2026) is not about becoming rich.

It’s about becoming calm.

Start small.

Stay consistent.

Let confidence compound.

If this guide helped you, take the next step:

👉 Choose one app.

👉 Set week one amount.

👉 Start today—not Monday.

🔗 INTERNAL & EXTERNAL LINKING SUGGESTIONS

Internal Links

- Personal Finance for Beginners in India

- Best Money Saving Habits in India

- SIP vs RD vs Savings Account

- Emergency Fund for Indian Families

External Links (Authority)

• RBI – Financial Education Portal

• SEBI – Investor Awareness

• India.gov.in – Financial Literacy

💸 AFFILIATE RECOMMENDATION

If tracking money feels messy, I strongly recommend using one dedicated app for this challenge.

I personally prefer apps that:

• Separate savings visually

• Allow auto-debit

• Show progress weekly

That clarity alone can save you from breaking the challenge mid-way.

Choose one. Keep it boring. Let the system work.

FAQs – Real Questions Indians Ask

Is the 26-week savings challenge india suitable for low income?

Yes. Even ₹200 per week works. Consistency matters more than amount.

Can I pause the challenge?

Try not to. If needed, reduce the amount—don’t stop.

Is this better than SIP?

This builds the habit. SIP comes next.

Where should I keep the money?

Separate account or RD. Avoid cash.

What if I miss a week?

Continue next week. No guilt.

Can families do it together?

Yes. One of the best ways to build money culture.

Is this safe in 2026?

Yes. No market dependency if done via savings/RD.

Leave a Reply