Money in India feels different.

It carries emotion, responsibility, fear — and sometimes even guilt.

If you’ve ever opened your salary message, felt happy for five seconds and stressed for the next five minutes, you’re not alone. I’ve been there too. Most Indians I speak to — students, IT professionals, even homemakers — say the same thing:

“I earn. I spend. I don’t know where my money disappears.”

And that’s exactly why the 50-30-20 rule India has become one of the simplest, most peaceful budgeting methods for people who want clarity without complicated financial jargon.

This guide is not theoretical.

It’s real. It’s Indian. It’s emotional.

And if you read till the end, you’ll walk away with a clear plan for the next month — not confusion.

Let’s begin.

🧭 50-30-20 Rule India (2026 Guide)

What Exactly Is the 50-30-20 Rule?

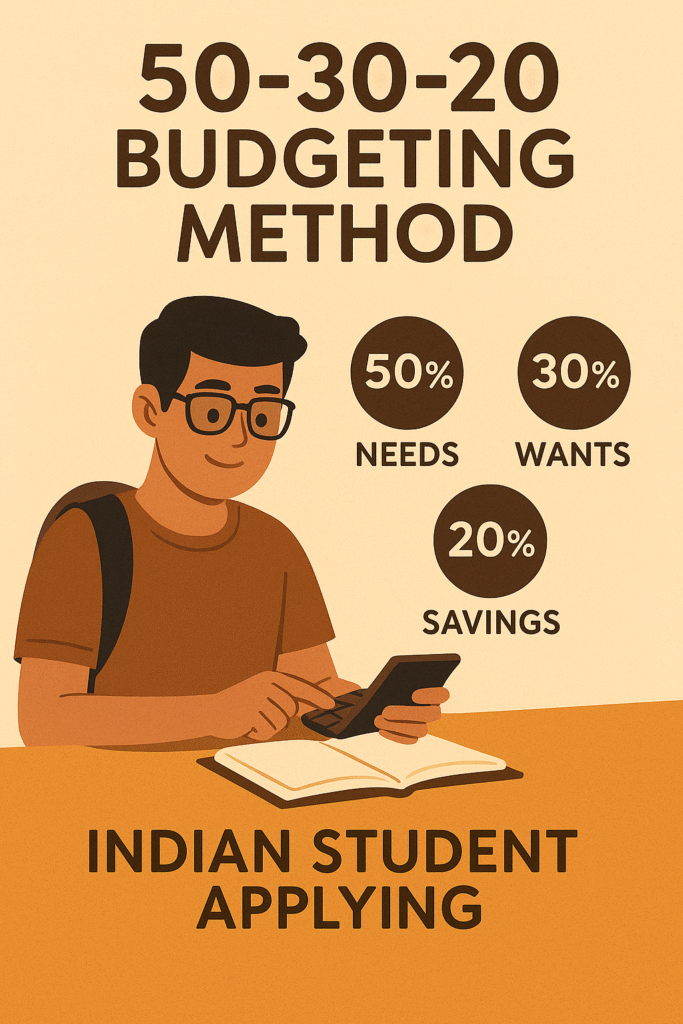

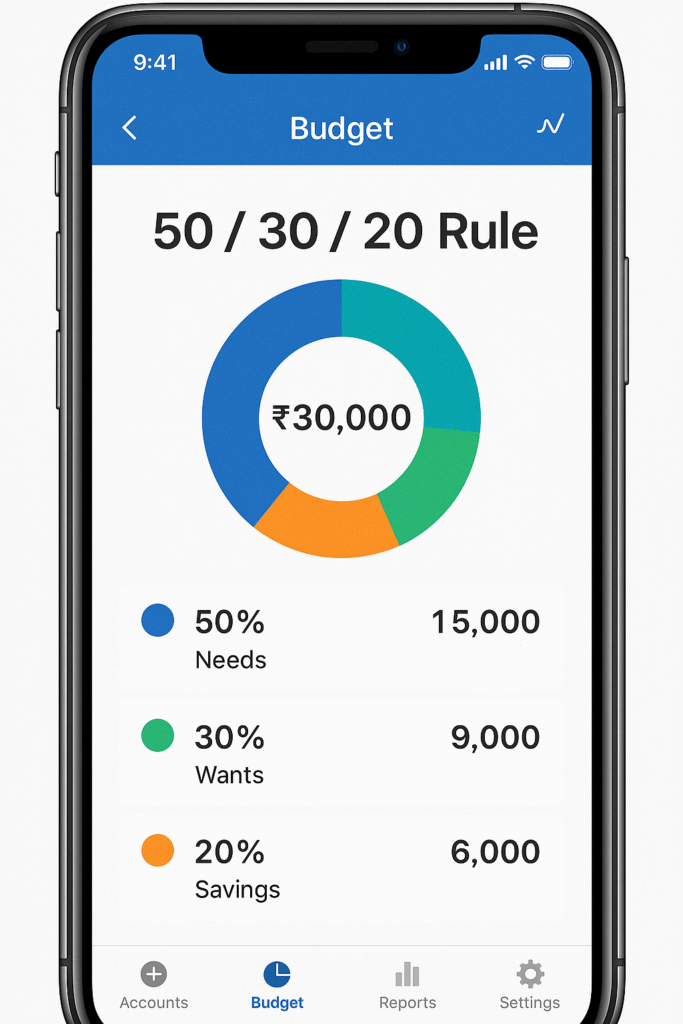

The 50-30-20 rule is a simple monthly budgeting formula:

| Category | Meaning | % of Income |

|---|---|---|

| 50% Needs | Essentials | Rent, groceries, EMIs, bills |

| 30% Wants | Lifestyle | Eating out, travel, shopping |

| 20% Savings & Investments | Future | SIPs, emergency fund, insurance |

But here’s the thing…

India is different. Our families, responsibilities, incomes, lifestyle expectations — everything has its own rhythm. So the original US-based rule doesn’t fully apply.

That’s why this 2026 India version is crafted for:

- single working professionals

- married couples

- middle-class families

- students

- and even retirees

Let’s break it down the Indian way.

⭐ Why the 50-30-20 Rule Works So Well for Indians

“The 50-30-20 rule India works well because Indian salaries vary widely across cities.”

Here’s the truth:

Most Indians don’t have a money problem.

We have a clarity problem.

The rule helps because:

- It removes guilt (“Can I spend on Zomato this week?” → Yes, from your Wants.)

- It builds consistency even with fluctuating incomes.

- It teaches discipline without being harsh.

- It’s easy enough to follow even if you hate budgeting.

And emotionally?

It gives that sweet confidence of knowing where your money is going — instead of feeling like your salary ghosted you.

🧩 Breaking Down the 50-30-20 Rule for India

1. The 50% — Needs (Your Essentials)

Needs are the non-negotiable payments you must make:

Typical Indian Needs:

- rent / home loan

- groceries

- electricity, water, Wi-Fi

- children’s school fees

- insurance premiums

- medical expenses

- EMIs

Real Indian Example

Raghav, a 28-year-old from Bengaluru, earns ₹45,000.

Here’s what his Needs look like:

| Expense | Monthly Cost |

|---|---|

| PG + maintenance | ₹10,000 |

| Groceries | ₹4,000 |

| Transport | ₹3,000 |

| Phone + Wi-Fi | ₹900 |

| EMIs | ₹2,500 |

Total Needs = ₹20,400 (45%)

(Perfectly within the 50% range.)

Signs Your Needs Are Too High:

- You wait for salary every month

- You fear even one emergency

- You swipe credit cards for groceries

How to Fix:

- shift to a cheaper house (biggest impact)

- reduce EMIs by refinancing

- use apps like Jupiter / Fi / Paytm for bill tracking

- buy only essentials from DMart / JioMart

2. The 30% — Wants (Lifestyle & Happiness)

Your Wants are things you can live without, but they bring joy.

Typical Wants in India:

- Swiggy/Zomato

- Movies / Netflix / Hotstar

- Amazon fashion

- Cafe coffees

- Weekends with friends

- Travel

- Gadgets

This section is emotional.

Because most Indians feel guilty spending on themselves.

But here’s a truth most of us forget:

You’re allowed to enjoy your money.

You work hard for it.

The 30% rule simply ensures you enjoy responsibly.

3. The 20% — Savings & Investments (Your Future)

This is the most powerful part of the entire rule.

Your 20% should go into:

Priority 1: Emergency Fund

Goal: 3–6 months of expenses

Where to keep: Jupiter/FI savings, Liquid Funds

Priority 2: Insurance

- Term insurance

- Health insurance (ideal cover: ₹10–20L)

Priority 3: Investments

- SIP in index funds: Nifty 50, Sensex

- Mutual funds via Groww, ET Money

- PPF for long-term goals

- NPS for retirement

Example (₹50,000 salary)

20% = ₹10,000

Breakdown:

- ₹4,000 → SIP

- ₹3,000 → Emergency fund

- ₹3,000 → Insurance + long-term

🔥 How to Apply the 50-30-20 Rule India in Real Life

Let’s make this practical and emotional — not just numbers.

Step 1: Calculate Your Monthly Take-Home

Not CTC.

Not gross salary.

Your real, in-hand money.

Step 2: Categorize Your Spending

Use:

- Fi Money buckets

- Jupiter pots

- Notion templates

- Google Sheets

- ET Money Smart Budgeting

Step 3: Create Auto-Debits

Automate:

- SIP (Groww/Zerodha)

- RD / emergency fund

- insurance

Step 4: Control Lifestyle Inflation

Every Indian knows this moment:

Salary increases → suddenly everything becomes “affordable”.

Danger zone.

Lifestyle inflation kills wealth.

Step 5: Review Every 90 Days

Life changes.

Your budget should too.

🏡 50-30-20 Rule India Examples for Different Groups

1. Indian Students

| Category | Amount (₹12,000 allowance) |

|---|---|

| Needs | ₹6,000 |

| Wants | ₹3,600 |

| Savings | ₹2,400 |

Practical tips:

- use UPI apps for tracking

- share OTT with friends

- buy used books

- create a mini SIP (₹500)

2. Single Working Professionals (₹35,000 salary)

| Category | Amount |

|---|---|

| Needs | ₹17,500 |

| Wants | ₹10,500 |

| Savings | ₹7,000 |

Tips:

- shift to co-living PG

- reduce Swiggy orders

- start one good SIP

- maintain emergency fund

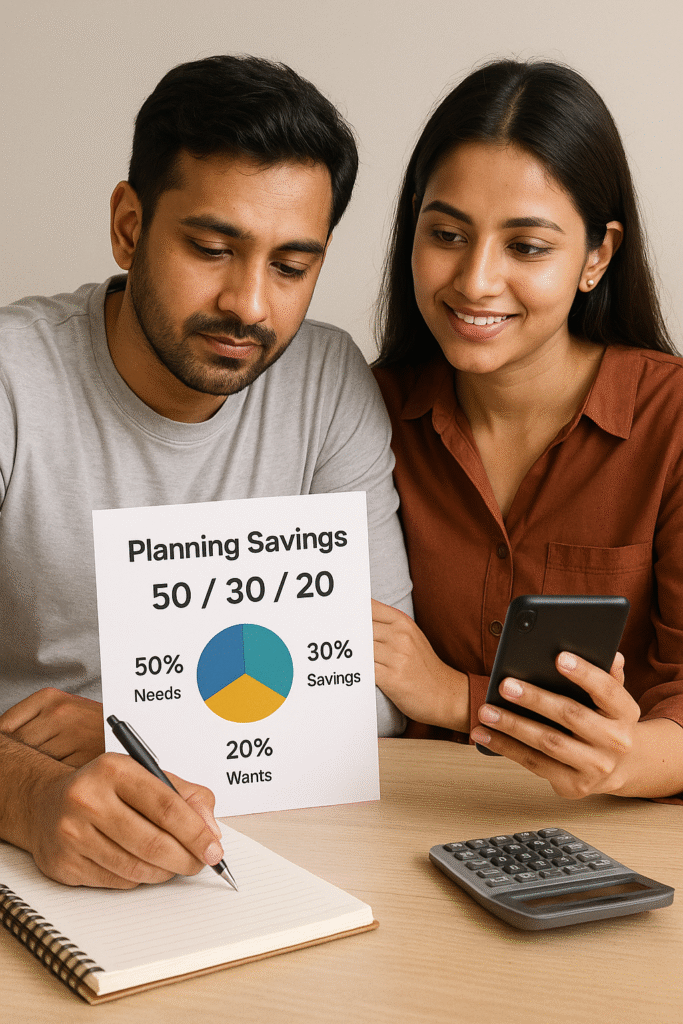

3. Married Couple (₹80,000 combined)

| Category | Amount |

|---|---|

| Needs | ₹40,000 |

| Wants | ₹24,000 |

| Savings | ₹16,000 |

Tips:

- track groceries

- plan travel early

- avoid EMI-based gadgets

- take family health cover

4. Indian Family with Kids (₹1,20,000 salary)

| Category | Amount |

|---|---|

| Needs | ₹60,000 |

| Wants | ₹36,000 |

| Savings | ₹24,000 |

Tips:

- systematic school fee planning

- grow groceries at DMart or wholesale

- save for children’s education via PPF/SIP

🎯 Modified Version — The 50-30-20 Rule for Low Salary Indians

Let’s be honest.

If your salary is under ₹25,000, the rule becomes tough.

So here is a realistic version:

Needs: 60%

Wants: 20%

Savings: 20%

Even saving ₹1,000 monthly matters.

💡 Tools to Help You Follow the Rule

These tools genuinely help — no hard selling.

“These apps help Indians follow the 50-30-20 rule India without confusion.”

✔ Groww

Best for SIPs, PPF tracking, and starting investments.

✔ Zerodha Coin

For long-term investing with direct mutual funds.

✔ Fi Money / Jupiter

For budgeting, pots, and auto-saving rules.

✔ ET Money

Great for insurance + expense tracking.

✔ Amazon Basics

For low-cost home essentials to reduce monthly expenses.

Each tool solves a real problem:

tracking, automation, or reducing impulse spends.

“If you start following the 50-30-20 rule India, your financial clarity will improve every month.”

🔗 Internal Linking Suggestions

- How to Start Investing in India (Beginner Guide) – Pillar

- Best Budgeting Apps for Indians

- SIP vs FD: Which Is Better in 2026?

- How to Build an Emergency Fund in India

- Money Mistakes Indians Should Avoid in Their 20s

🌍 External Authoritative Links

- RBI Household Finance Report

- AMFI India Mutual Fund Data

- SEBI Investor Education

- Govt. of India PPF/NPS information pages

FAQ

Can I follow the rule if I earn less than ₹20,000?

Yes — try 60-20-20 instead. Focus on emergency fund first.

Should EMIs be included in Needs?

Yes. Any essential monthly obligation goes under Needs.

What if I can’t save 20% every month?

Save 5%, then 10%, then increase slowly. Consistency is the real magic.

Is investing better than saving?

You need both: emergency fund + long-term investments.

Can students use this rule?

Absolutely! It builds early money discipline.

Which app is best to track the 50-30-20 rule in India?

Jupiter, Fi, and ET Money offer the best Indian budgeting features.