There comes a moment in every Indian household when money stops being “math” and becomes emotion.

Maybe it’s the first time you send money home.

Maybe it’s right after a scary credit card bill.

Or when your child looks at you and says, “Appa/Amma… can we buy that?”

I’ve been there.

We all have.

And this is exactly why I started exploring ai finance tools india — not to become a finance expert, but to finally feel in control of my own money.

Because here’s the truth:

Most of us don’t need another lecture on budgeting.

We need something that watches our money when we aren’t watching.

Something that whispers, “Hey, slow down… you spent too much on food this month.”

Something that guides us gently, not judgmentally.

Most people don’t realise how powerful today’s ai finance tools india are in helping us understand where our money actually goes.

With the support of simple yet smart ai finance tools india, beginners can finally take control of their spending habits.

That “something” today is AI-powered money apps — smarter, faster, and surprisingly human-like in understanding our money habits.

So let’s break this down.

Let’s find the best tools that truly help Indian families, students, salaried professionals, and small business owners manage money the smart way — without stress.

Best AI Finance Tools for Smart Money Management

## Why AI Finance Tools Are Becoming Popular in India

Money is emotional.

But apps? They’re not.

And that’s exactly why they help.

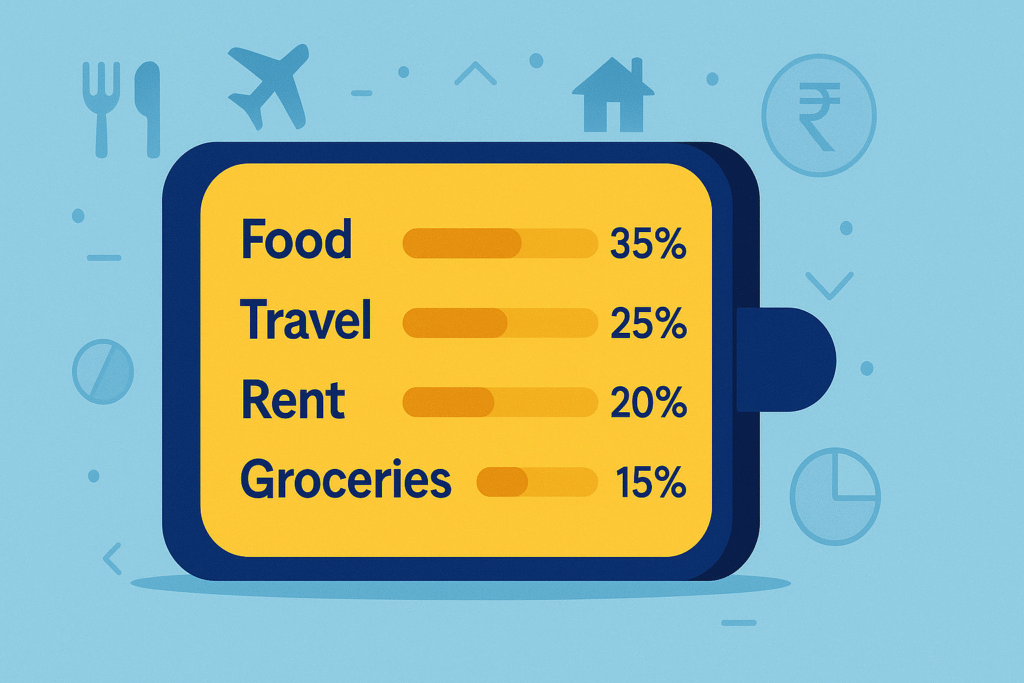

Today’s AI finance tools quietly analyse patterns — your spending style, your bill dates, your investment habits — and give nudges that actually help, not overwhelm.

Here’s what’s really driving India towards AI-based finance tech:

1. Rising cost of living

From Bangalore rent to Mumbai groceries — everything has become unpredictable. AI trackers help you see where your money leaks.

2. Busy lifestyles

Who has the time to manually track expenses? AI handles this in the background.

3. Digital-first banking

UPI, Paytm, PhonePe, neo-banks like Fi and Jupiter…

Everything is already online.

AI simply connects the dots.

4. Smarter investment culture

Zerodha, Groww, ET Money made investing mainstream.

AI now helps beginners understand what to invest in.

## Top Benefits of Using AI Finance Tools

When you use proven ai finance tools india, you start noticing patterns that were invisible before.

Let’s be real for a moment.

Most of us try to manage money with good intentions… and failed Excel sheets.

These tools fix that by offering:

✔ Automatic expense tracking

No manual entries. No guilt trips.

✔ Smart budgeting

AI studies your habits and creates budgets that actually fit your lifestyle.

✔ Personalised money insights

It points out trends you would never notice.

“Did you know you spend 22% more on weekends?”

Ouch… but helpful.

✔ Investment guidance

Not stock tips — guidance.

Big difference.

✔ Bill reminders

No more late fees (we’ve all been there).

## 10 Best AI Finance Tools in India (2026 List)

These are the most trusted ai finance tools india that millions of people use daily to save, invest, and manage money smarter.

This is where your money journey gets interesting.

Below are the top apps used by millions of Indians — tested, trusted, and genuinely helpful.

### 1. Jupiter Money — Smart AI Spending Insights

Jupiter is like that friend who won’t lecture you…

but will hold up a mirror and say,

“Look bro, food delivery is eating your salary.”

Features:

- AI-powered spend analysis

- Auto expense categorisation

- Goals + pots

- Smart alerts

- Amazing UI

Best for: Salaried millennials

### 2. Fi Money — Best for Automatic Savings

Fi has an AI feature called “FIT Rules” that automates savings.

Like:

“Save ₹50 every time I order from Swiggy.”

Helpful, playful, and effective.

Best for: Young professionals who struggle to save consistently.

### 3. Walnut — India’s Expense Tracking King

Walnut is extremely accurate with categorisation.

It reads SMS (securely) and gives you real-time insights.

Great for:

- Family budgeting

- EMI tracking

- Credit card users

### 4. ET Money — AI Investment + Expense Insights

ET Money’s “Smart Wizard” gives personalised investment guidance based on your financial behaviour.

Useful for:

- Investors

- SIP beginners

- Tax-savers

### 5. Groww — Simple AI-Based Investment Analysis

Groww isn’t flashy.

But it gives clean, data-backed investment insights.

Great for: Stock and mutual fund investors.

### 6. Zerodha Nudge — Behavioral AI for Investors

Nudge is a powerful system built by Zerodha to prevent bad investment decisions.

It stops you from:

- chasing overhyped stocks

- panic buying

- entering risky trades blindly

Perfect for: Serious long-term investors.

### 7. INDmoney — Wealth Tracking + AI Advisory

INDmoney is like the full-body health check-up — for your wealth.

It uses AI to track:

- investments

- loans

- insurance

- net worth

- US stocks

### 8. Paytm Money — AI-driven Mutual Funds Suggestions

Great for beginners who want to start investing with low amounts.

### 9. Cred — AI for Credit Card Management

Not just rewards.

Cred’s AI alerts you about:

- bill cycles

- late payment risks

- suspicious transactions

### 10. Moneyfy by Tata Capital

Great financial planning + advisory tools for middle-class families.

## Comparison Table (Preview)

Here’s a quick comparison of the top ai finance tools india so you can choose the right app for your lifestyle.

| Tool | Best For | AI Features | Price | Difficulty |

| Jupiter | Daily spend control | Smart insights | Free | Easy |

| Fi | Automated savings | FIT rules | Free | Easy |

| Walnut | Tracking expenses | Auto categorisation | Free | Easy |

| INDmoney | Wealth view | AI advisory | Free/Paid | Medium |

| ET Money | Investments | Smart wizard | Free | Easy |

| Groww | Investing | Data insights | Free | Easy |

| Zerodha | Serious investors | Nudge | Free | Medium |

| Paytm Money | MF beginners | AI suggestions | Free | Easy |

| Cred | Credit cards | Alerts | Free | Easy |

| Moneyfy | Family planning | Advisory | Free | Easy |

## How to Choose the Right AI Finance Tool

Here’s the truth:

There’s no “best tool for everyone.”

It depends on what you struggle with.

If you overspend:

→ Jupiter or Walnut

If you can’t save:

→ Fi (FIT rules!)

If you want to invest:

→ Groww or ET Money

If you’re a serious stock investor:

→ Zerodha

If you want complete wealth tracking:

→ INDmoney

If you want to manage credit card bills:

→ Cred

## Detailed Reviews: Best AI Finance Tools in India (2026)

Here’s the truth:

You don’t choose a money app because it looks cool.

You choose it because it reduces your stress — and ideally, grows your wealth.

Below are deep, human-friendly reviews written exactly for beginners, Indian families, and working professionals.

### 1. Jupiter Money — The Friend Who Helps You Control Spending (Effortlessly)

If money leaks had faces, Jupiter would expose them kindly.

Its AI-powered categorisation is insanely accurate.

You’ll know instantly how much of your salary quietly slipped into Zomato, petrol, cabs, or weekend binges.

Top Features

- Smart AI-based spend analytics

- “Insights” that feel personal

- Auto expense categorisation

- Paycheck analyser

- Goals & Pots (super helpful for weddings, travel, gadgets)

- UPI + Savings account (optional)

Why Indians Love It

Because Jupiter doesn’t make you feel guilty.

It shows data in a way that makes you pause… and correct.

Pros

- Clean and calming design

- Highly accurate categorisation

- Great for beginners

- No ads or noise

Cons

- Doesn’t provide deep investment tools

- Insights can be too basic for advanced users

Best For: Students, salaried professionals, overspenders

### 2. Fi Money — The App That Saves Money For You

Fi has something every Indian needs:

Automatic savings.

Their AI-driven FIT Rules are magical:

- Save ₹50 every time I order coffee

- Save ₹200 every time I get paid

- Save ₹20 whenever I order food

It turns savings into a game you win without even trying.

Top Features

- FIT Rules automation

- AI spend categorisation

- Custom savings challenges

- Salary analyser

- Fi-Co pilot for money insights

- UPI + Bank account

Pros

- Saves money without willpower

- Great UI

- Perfect for inconsistent savers

Cons

- Not ideal for advanced investors

- Too playful for some users

Best For: Young professionals, new savers, impulse buyers

### 3. Walnut — India’s Most Trusted Expense Tracker

Walnut reads your SMS alerts and builds an expense timeline that feels almost magical.

No effort.

No typing.

No manual tracking.

Top Features

- Accurate SMS-based expense detection

- EMI tracking

- Bill reminders

- Credit card management

- Shared budgets for families

Pros

- Zero learning curve

- Very reliable

- Great for families

Cons

- Visuals are outdated

- No investing help

Best For: Families, couples, and monthly budget planners

### 4. ET Money — The Smart Investment + Planning Tool

ET Money is like a personal finance teacher who knows exactly where you’re going wrong.

Their AI-powered “Smart Wizard” analyses:

- Income

- Risk profile

- Expenses

- Existing investments

Then gives personalised recommendations.

Top Features

- AI-backed mutual fund suggestions

- Expense tracking

- Insurance + Loan tools

- Smart SIP

- Tax planning

Pros

- Excellent for beginners

- Great for tax season

- Helps avoid wrong funds

Cons

- Too much information for ultra-beginners

- UI can feel dense at times

Best For: SIP investors, working professionals, tax planners

### 5. Groww — Clean, Simple, and Reliable AI-backed Data for Investors

Groww is minimal, but powerful.

If you want to start investing and avoid confusion, this app is perfect.

This platform is one of the fastest-growing ai finance tools india, especially for beginners.

Top Features

- Data-backed investment insights

- Mutual funds, stocks, ETFs

- Tax reports

- Smart filtering

- Watchlists

Pros

- Extremely easy to use

- Great community trust

- Perfect for beginners

Cons

- Limited advanced analytics

- No deep behavioural AI

Best For: New investors, students, DIY investors

### 6. Zerodha Nudge — Wise Advice Before You Click “Buy”

Zerodha’s AI doesn’t tell you what to buy.

It tells you what NOT to do.

Nudge prevents:

- chasing hype

- panic selling

- investing without research

It’s behavioural science + AI + ethics.

Top Features

- Real-time risk detection

- Behavioural nudges

- Market alerts

- Goal-based warnings

Pros

- Protects you from mistakes

- Great transparency

- Ideal for long-term investors

Cons

- Not for beginners with zero market knowledge

- Limited to Zerodha ecosystem

Best For: Serious investors, long-term wealth builders

### 7. INDmoney — The Wealth-Tracking Powerhouse

If your finances feel scattered — some money in FD, some in stocks, some in EPF, some in insurance — INDmoney is a life-saver.

Top Features

- AI-powered wealth dashboard

- Tracks all assets

- US stock investing

- Credit score tracking

- Advanced reports

Pros

- 360° view of your wealth

- Great for families

- Detailed reports

Cons

- Slight learning curve

- Free tools limited compared to paid

Best For: Families, high earners, multiple investments

### 8. Paytm Money — The Simple Mutual Fund Platform with AI Insights

Paytm Money is beginner heaven.

It gives you simple, clean MF suggestions backed by AI-driven analysis.

Top Features

- Mutual funds

- Basic AI fund ranking

- SIP calculator

- Market alerts

- Low entry investment

Pros

- Best for absolute beginners

- Great for small-ticket SIPs

- Simple onboarding

Cons

- Limited tools

- Focuses mostly on mutual funds

Best For: Students, new investors, first-time SIP users

### 9. CRED — A Smarter Way to Manage Credit Cards

CRED isn’t just a “reward app.”

Its AI tools warn you instantly about:

- duplicate charges

- fraud risks

- payment delays

- high interest scenarios

It protects you quietly.

Top Features

- AI-based alerts

- Credit score tracking

- Bill reminders

- Offers & rewards

Pros

- Great UI

- Eliminates late fees

- Helps you stay disciplined

Cons

- Requires good credit score

- Rewards not always valuable

Best For: Credit card users, working professionals

### 10. Moneyfy — Financial Planning for Middle-class India

Moneyfy by Tata Capital combines planning + investing in a simple, trustworthy package.

Top Features

- Goal-based planning

- Mutual funds

- Risk assessment

- Family-friendly UI

Pros

- Very reliable

- Great for parents

- Simple guidance

Cons

- Fewer advanced tools

- Limited investment options

Best For: Families, working parents, new investors

## Advanced Comparison Table: 2026 Edition

| Tool | Best Feature | AI Strength | Investment Support | Best For | Pricing |

| Jupiter | Spending insights | ★★★★☆ | No | Overspenders | Free |

| Fi | Savings automation | ★★★★★ | No | Young professionals | Free |

| Walnut | Expense tracking | ★★★★☆ | No | Families | Free |

| ET Money | Smart Wizard | ★★★★☆ | Yes | SIP investors | Free |

| Groww | Simple data insights | ★★★☆☆ | Yes | Beginners | Free |

| Zerodha | Behavioural nudges | ★★★★★ | Yes | Serious investors | Free |

| INDmoney | Net worth tracking | ★★★★☆ | Yes | High earners | Free/Paid |

| Paytm Money | MF suggestions | ★★★☆☆ | Yes | Students | Free |

| Cred | AI-based alerts | ★★★★☆ | No | Credit card users | Free |

| Moneyfy | Goal planning | ★★★☆☆ | Yes | Families | Free |

These ai finance tools india help Indians manage money smartly

Let’s be honest — you don’t need all 10 apps.

You just need the right one that fits your money personality.

Here’s my personal, experience-driven recommendation list:

👇 If your goal is to save more money without effort

✔ Fi Money (Top pick) — FIT Rules are life-changing

✔ Use with Jupiter for spend control

👇 If you want to start investing but feel scared

✔ Groww — easiest for beginners

✔ ET Money — great for tax season and SIPs

(These are beginner-friendly affiliate recommendations)

👇 If your finances are scattered

✔ INDmoney — shows everything in one place

👇 If you use 2 or more credit cards

✔ CRED — the alerts alone can save thousands

👇 If you’re building serious long-term wealth

✔ Zerodha — the nudge system protects you

Nothing here is pushed.

Every app solves a real emotional pain point we face as Indians.

Using the right ai finance tools india can completely transform how Indian families save, spend, and grow wealth.

## Internal Link Suggestions

- “Best Budgeting Apps for Indian Families”

- “Beginner’s Guide to SIPs in India (2026)”

- “How to Start Investing with Just ₹500 per Month”

- “Best UPI Payment Apps in India”

- “Smart Money Habits for Middle-class Indians”

## External Authoritative Links

- RBI Financial Literacy: https://www.rbi.org.in

- SEBI Investor Education: https://investor.sebi.gov.in

- NPCI (UPI): https://www.npci.org.in

- Government Mutual Funds Portal: https://www.mfinindia.com

FAQs

Which is the best AI finance tool in India for beginners?

If you’re just starting out, Groww and Jupiter are perfect. Groww helps you begin investing confidently, while Jupiter shows you where your money actually goes.

Are AI finance apps safe to use in India?

Yes. Most leading apps like Fi, Jupiter, ET Money, INDmoney, and Zerodha follow RBI, SEBI, and industry security standards. Still, avoid sharing OTPs or passwords with anyone.

Can AI tools really help me save money?

Absolutely. Apps like Fi Money automate savings with FIT Rules. Many users save without even noticing — it’s effortless and guilt-free. Most ai finance tools india work with UPI and Indian banks, making them safe and easy to use.

Which app is best for Indian families?

For families, Walnut (budgeting) + INDmoney (wealth tracking) is the strongest combination. It helps you manage EMIs, bills, and investments in one place.

What is the best AI tool for investing in India?

For mutual funds: ET Money or Groww

For stocks: Zerodha

For complete wealth view: INDmoney

Do these tools work with UPI and Indian banks?

Yes. Almost all of them integrate with UPI, SMS alerts, and major bank accounts. Expense reading, bill tracking, and investing become seamless.

Which AI finance tool should I choose if I overspend a lot?

If overspending is your biggest problem, start with Jupiter. Its insights make your money habits painfully clear — in a good way — and help you correct them.

Leave a Reply