Most people in India start investing with hope. Hope that the market will rise. Hope that their stocks will perform. Hope that things will work out.

But hope isn’t a strategy.

I still remember my colleague Vikram, a young IT engineer from Bengaluru. He used to invest based on tips—WhatsApp groups, office gossip, YouTube “hot picks”. Sometimes he made money, but most of the time he didn’t even understand why his stock went up or down.

One day, after a 12 percent drop in a single week, he told me, “I wish there was a way to know what’s coming before the market changes.”

Today, there is.

AI-driven models, predictive analytics, and machine learning tools are helping ordinary Indian investors understand stock trends before they become headlines. And that’s where the real shift is happening.

If you’re searching for ai stock market india to understand how this works, you’re in the right place.

Let’s break it down.

Let’s make it simple.

Let’s make it useful.

AI Predicts Stock Market Trends

Understanding AI Stock Trend Predictions

Artificial intelligence is not magic. It’s math, patterns, and large-scale data crunching. But for Indian investors, it feels magical because it finally answers the biggest question:

“What might happen next?”

Here’s the truth:

AI doesn’t predict the exact price of a stock.

But it does identify probable trends, market direction, and signals much faster and more accurately than humans.

Think about it.

A human investor can read 5–10 annual reports.

An AI model can analyze 10,000+ data points in seconds.

A human investor might panic during volatility.

An AI model only reacts to data, not emotion.

What AI Looks At Behind the Scenes:

AI models in India typically track:

• Price history of stocks

• Breakout patterns

• Moving averages

• Volume spikes

• FII/DII activity

• Company financial ratios

• News sentiment (positive/negative)

• Social media buzz

• Global market cues

• Commodity prices

• Macro indicators (inflation, interest rates, GDP)

If this sounds complicated, don’t worry.

We will break everything down with Indian examples.

Why AI Stock Trend Prediction Matters in India

India is not a typical market. It’s emerging, emotional, and fast-moving.

Three things make AI extremely important here:

1. Retail Investors Are Growing Fast

Platforms like:

• Groww

• Zerodha

• Upstox

• Paytm Money

…have added millions of first-time investors since COVID-19.

These investors need guidance. AI fills that gap.

2. Indian Markets React Quickly to News

Example:

• A government policy change

• Budget announcements

• RBI repo rate decisions

• Adani/Hindenburg-type events

AI models track and react to news faster than the human brain can process.

3. India’s Data Ecosystem is Strong

Thanks to platforms like:

• NSE

• BSE

• TickerTape

• MoneyControl

• Trendlyne

AI tools now have richer data to work with.

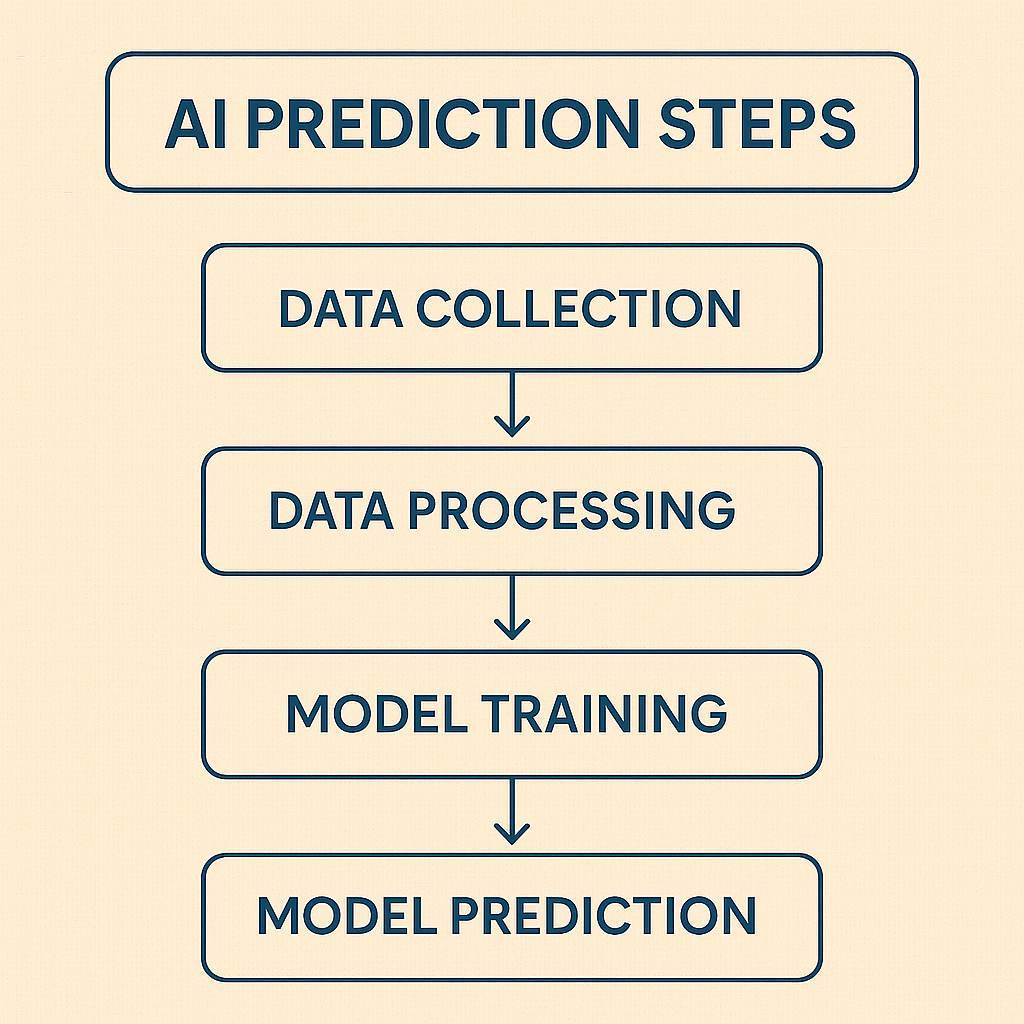

How AI Predicts Stock Market Trends: Step-by-Step Guide

Let’s break this down into an easy-to-understand workflow.

Below is a simple Indian-friendly flow of how predictive AI works:

Step 1 — Data Collection

AI gathers years of historical data from NSE/BSE:

| Type of Data | Example |

|---|---|

| Prices | Daily close of TCS, Reliance, HDFC Bank |

| Volumes | Trading activity |

| Financials | EPS, PE, ROE, debt levels |

| Macro | Inflation, crude oil, USD/INR |

| Sentiment | News, social trends |

Step 2 — Data Cleaning

India has many events that distort data:

• Elections

• Budget days

• Sudden political announcements

AI systems remove noise and keep only usable signals.

Step 3 — Pattern Recognition

AI identifies:

• Breakout signals

• Reversal patterns

• Support & resistance zones

• Unusual volumes

• FII vs DII flows

This is where machine learning shines.

Step 4 — Predictive Modeling

Models used in India include:

• LSTM neural networks

• Random Forest

• SVM (Support Vector Machines)

• Sentiment analysis engines

• Reinforcement learning

These models run simulations to predict probability-based outcomes.

Step 5 — Output for Investors

AI tools convert complex data into:

• Buy/Sell indicators

• Trend signals

• Risk scores

• Expected direction

• Confidence levels

Instead of guessing, investors now see:

“This stock has 82% probability of upward trend in the next 14 days.”

Pro Tips, Common Mistakes & Insider Secrets

AI helps—but only when used properly.

Mistake 1 — Blindly Trusting AI Calls

AI is not 100 percent accurate.

Use it as a guide, not a guarantee.

Mistake 2 — Using Tools Without Understanding Risk

Your risk appetite matters more than any prediction.

Mistake 3 — Focusing Only on Short-Term Signals

Most beginners chase daily predictions.

The real value of AI comes from trend alignment, not intraday tips.

Pro Secrets (Indian Context)

Secret 1: AI works best when combined with fundamentals

For example:

• A fundamentally strong stock + positive AI trend = high probability win.

Secret 2: AI sentiment analysis is powerful in India

A single news headline can move:

• Tata stocks

• PSU stocks during budget

• Banking stocks during rate hikes

AI tools catch these signals instantly.

Secret 3: AI helps avoid emotional mistakes

Most losses happen because of:

• Fear

• Greed

• Overconfidence

• Panic selling

AI is emotion-free.

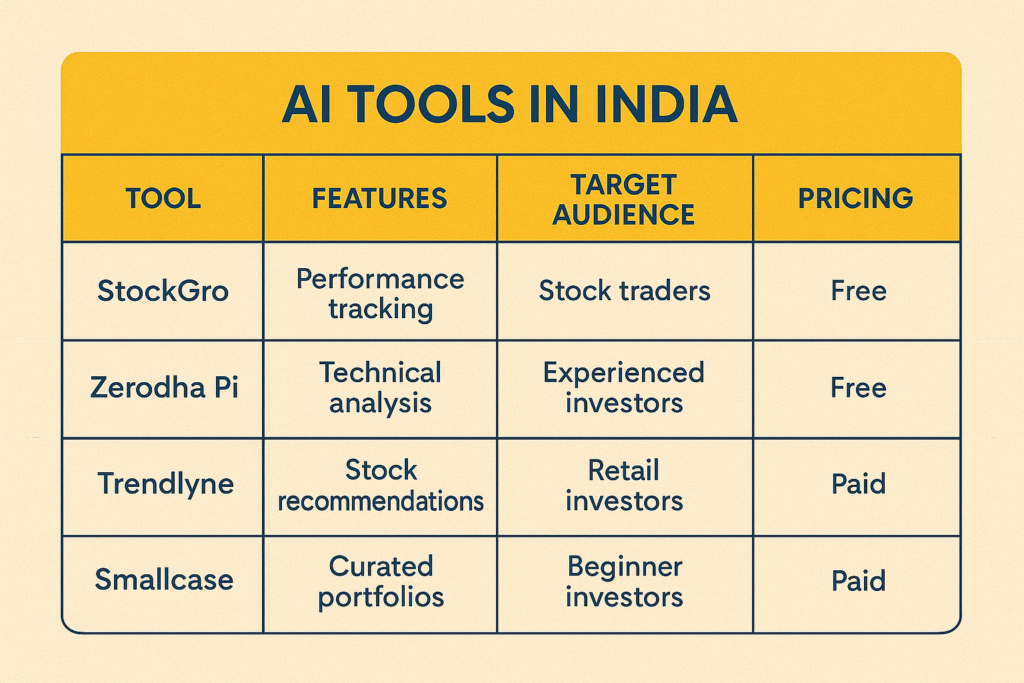

Comparison Table — Indian AI Stock Tools

| Tool | Best For | Pros | Cons |

|---|---|---|---|

| Tickertape | Trend analysis | Clean UI, data-rich | Limited deep AI |

| Trendlyne | Forecasting | DVM score, predictions | Can overwhelm beginners |

| Smallcase | AI-based portfolios | Expert strategies | Not stock-specific |

| ET Money Genius | Passive AI investing | Hands-free | Subscription cost |

| Zerodha Streak | Algo trading | Backtesting, ML | No long-term predictions |

| MarketMojo | Stock scoring | Strong fundamentals AI | Some data behind paywall |

Real-Life Indian Stories

Story 1: The Chennai Homemaker Who Outsmarted Her Broker

Priya, a homemaker from Chennai, always relied on recommendations from relatives. After losing money in 2022, she started using AI trend tools on ET Money and Trendlyne.

She stopped guessing.

She stopped following tips.

She started following data.

Her returns improved from -5% to +14% in 10 months.

Story 2: The Pune College Student Who Built Confidence

Arjun, a 21-year-old commerce student, used Groww’s AI-powered insights. Instead of panicking during market dips, he started checking sentiment and historical trend data.

His confidence grew.

He learned discipline.

He invested smarter.

Story 3: The Mumbai IT Professional Who Upgraded His Strategy

Vikram, the engineer from the introduction, now uses Streak and Trendlyne.

He told me, “I finally understand why the market is moving.”

That’s the power of AI.

Tools, Apps & Resources

1. Groww – Best for Beginners

What I like:

• Simple AI insights

• Risk labeling

• Trend indicators

Why it helps:

You understand market mood before entering a stock.

2. Zerodha Streak – Best for Algo + ML Trading

What I like:

• Backtesting

• Strategy builder

• Trend forecasting

Why it helps:

You stop trading emotionally and start trading systematically.

3. Trendlyne – Best for Deep AI Predictions

What I like:

• Forecasts

• DVM scores

• Stock health

Why it helps:

Gives confidence for medium-term investing.

4. ET Money Genius – Best for Passive AI Investing

Why it helps:

Investors who hate research can let AI rebalance portfolios automatically.

Final Thoughts — A Warm Closing

If you’ve ever felt confused, overwhelmed, or unsure about the stock market, you’re not alone. Almost every Indian investor starts that way.

But today, you have an advantage that previous generations never had:

AI that converts data into clarity.

You don’t need to be a finance expert.

You don’t need to predict the future.

You simply need the right tools to understand trends before they hit the news.

Use AI to guide you.

Use fundamentals to ground you.

Use patience to protect you.

And remember—every smart investor in India today is slowly shifting from guesswork to data-driven decisions.

You can too.

If you want to explore more, check out my guide on AI finance tools and long-term investing strategies.

Internal & External Linking Suggestions

Internal Links

- Best AI Tools for Indian Finance

- Stock Market Basics for Beginners India

- Long-Term Investing Strategies

- How to Start SIPs with Rs 500

External Links

- RBI – Monetary Policy and Financial Markets

- SEBI – Investor Education

- NSE India – Market Data & Indices

FAQs

Can AI really predict the stock market in India?

AI predicts probable trends, not exact prices. It works well for understanding direction and momentum in Indian markets.

Is AI stock market india search worth exploring for beginners?

Yes. Beginners benefit the most because AI reduces guesswork and emotional decisions.

Which Indian app uses AI for stock prediction?

Trendlyne, Zerodha Streak, MarketMojo, and ET Money use AI-based insights.

Can AI help avoid stock market losses?

AI reduces risk by identifying warning signals early, but no tool can eliminate losses completely.

Is AI better than human financial advisors?

AI is faster with data. Humans are better with personal goals. The best results come from combining both.

Does AI work for intraday trading in India?

It works, but intraday is highly volatile. AI performs better for short- to medium-term trend predictions.

How often should I check AI signals?

Once a day or even once a week is enough. Over-checking leads to stress.

Leave a Reply