If you’re searching for the best sip for beginners india, you’re not alone. Last Sunday at a tea shop, I overheard two students worried about choosing the right SIP…

“Bro, I want to start a SIP… but which fund should I choose?”

“Same da… if we pick the wrong one, money gone!”

You could literally feel the fear.

That fear isn’t just theirs.

Almost every first-time investor in India feels it.

Starting a SIP feels big. Emotional. Risky.

Especially when you’re young, earning your first salary, or supporting a family.

And trust me — I’ve seen this worry everywhere.

In 22-year-olds buying their first phone through EMI.

In 30-year-old parents wanting a better future.

In 40-year-olds who wish they had started earlier.

Here’s the truth:

👉 SIP is the simplest way for beginners in India to build wealth.

👉 You don’t need timing.

👉 You don’t need lakhs.

👉 You don’t need to be a “finance expert.”

You only need ₹500 and the right plan.

Today, we’ll break down the Best SIP Plans for 2026, created specially for sip for beginners india — with real fund recommendations, zero jargon, honest guidance, and simple steps.

Let’s start building wealth the Indian-friendly way.

🧠 Understanding SIP Basics (sip for beginners)

✔ What is a SIP ?

A SIP (Systematic Investment Plan) is just a monthly auto-deposit into a mutual fund.

Just like EMI, but instead of paying a loan, you’re building wealth.

✔ Why SIP works for beginners

- You invest small amounts

- You invest consistently

- You benefit automatically from ups and downs (rupee-cost averaging)

- You don’t need to time the market

- Zero stress

✔ How beginners lose money (important!)

Not because SIP is risky.

But because they:

- Choose the wrong category

- Stop SIP during market crashes

- Check NAV daily (very dangerous for mental peace!)

- Don’t stay invested long enough

🇮🇳 Why Best SIP Plans for 2026 Matter for India

India is changing fast.

Salaries are not doubling.

But expenses? Rent, food delivery, school fees, petrol — everything is rising.

Here’s what most people don’t realize…

👉 If you don’t invest, you’re automatically losing money to inflation.

👉 SIP is the only wealth tool that fits Indian middle-class lives.

👉 Starting early is more powerful than investing big.

A simple ₹1,500 SIP in a good fund for 20 years can grow to ₹13–18 lakhs depending on the fund.

Even ₹500 can change your future.

🔥 Best SIP Plans for 2026 (Perfect sip for beginners india)

Below is the carefully curated list for sip for beginners india — combining safety, long-term stability, and strong historical performance.

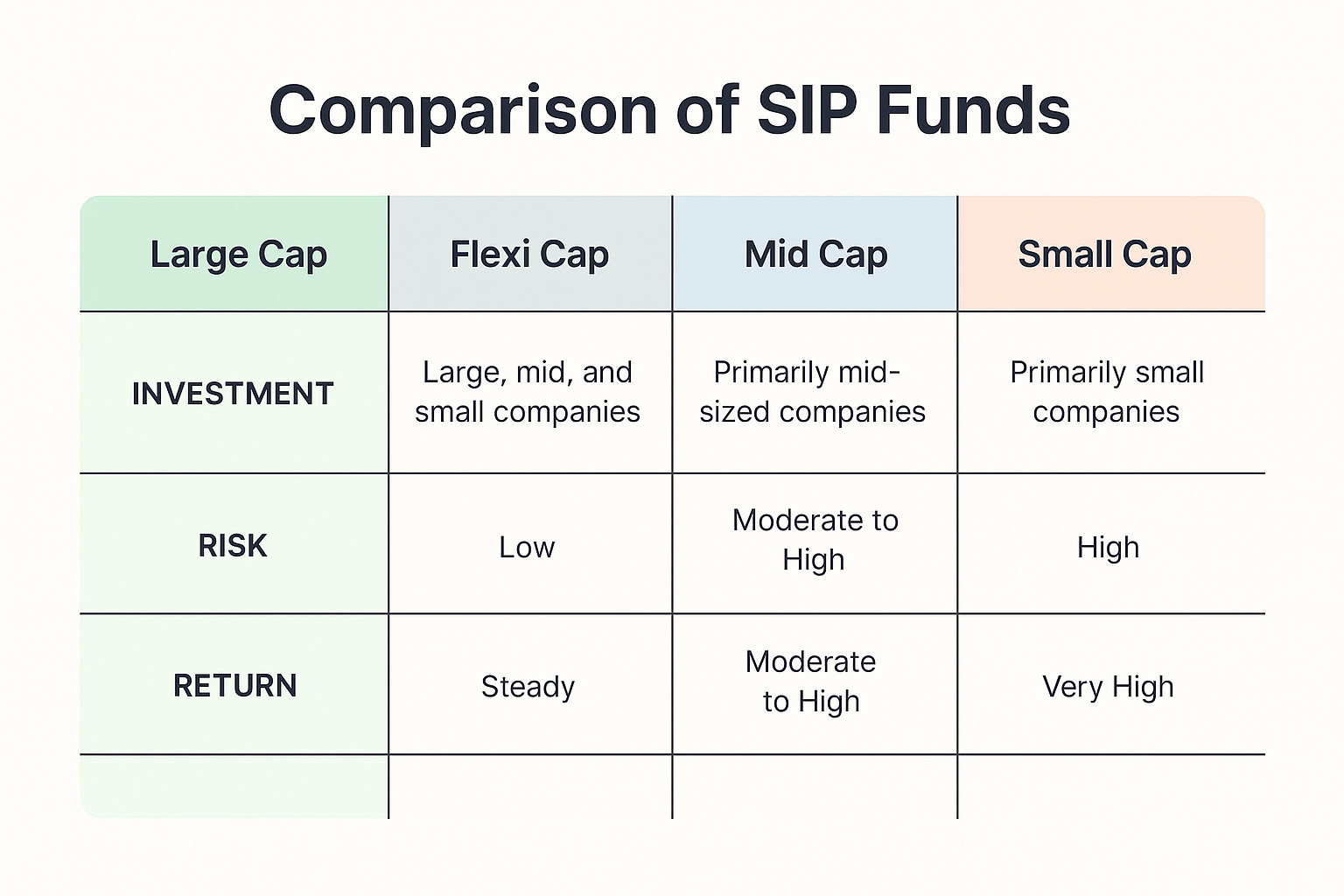

🟦 Category 1: Large Cap Funds (Safest for Beginners)

Large cap funds invest in India’s top 100 companies (Infosys, TCS, HDFC Bank).

⭐ Best Large Cap SIPs for 2026

| Fund Name | Why It’s Great for Beginners | Ideal SIP Amount |

|---|---|---|

| Mirae Asset Large Cap Fund | Very stable, consistent performance, beginner-friendly risk | ₹500–₹2000 |

| ICICI Prudential Bluechip Fund | Strong downside protection during crashes | ₹500–₹2500 |

| Axis Bluechip Fund | Good for beginners wanting steady growth | ₹500–₹2000 |

🟨 Category 2: Flexi Cap Funds (Best “All-Weather” Choice)

Flexi Cap funds invest in large, mid, and small companies.

⭐ Best Flexi Cap SIPs for 2026

| Fund Name | Why It’s Great | Suitable For |

|---|---|---|

| Parag Parikh Flexi Cap Fund | Global exposure + stable returns | Beginners who want safety + growth |

| Kotak Flexi Cap Fund | Excellent risk-adjusted returns | Long-term wealth seekers |

| HDFC Flexi Cap Fund | Simple, diversified, reliable | New investors |

This category is often the #1 recommended for sip for beginners india.

🟥 Category 3: Mid Cap Funds (Higher growth, slightly higher risk)

Good for beginners who can stay invested 5–7+ years.

⭐ Best Mid Cap SIPs for 2026

| Fund Name | Why It’s Great | Minimum Horizon |

|---|---|---|

| Kotak Emerging Equity Fund | Strong long-term performance | 5+ years |

| Axis Midcap Fund | Stable, clean portfolio | 5–7 years |

| Nippon India Growth Fund | Aggressive growth | 7+ years |

🟩 Category 4: Small Cap Funds (High risk, high reward)

Only recommended if you’re willing to stay for 10–12 years.

⭐ Best Small Cap SIPs for 2026

| Fund Name | Why It’s Great | For Whom |

|---|---|---|

| SBI Small Cap Fund | Top long-term performer | Young beginners (20s & 30s) |

| Quant Small Cap Fund | High growth potential | High-risk takers |

| Axis Small Cap Fund | Consistent strategy | Balanced risk beginners |

🟫 Category 5: Hybrid Funds (Perfect for Safe Beginners)

These combine equity + debt = stability + growth.

⭐ Best Hybrid SIPs for 2026

| Fund Name | Why It’s Great | Recommended For |

|---|---|---|

| HDFC Hybrid Equity Fund | Excellent balance | Beginners afraid of volatility |

| ICICI Prudential Balanced Advantage Fund | Dynamic asset allocation | Conservative investors |

| Mirae Asset Hybrid Equity Fund | Steady returns | First-time SIP users |

📌 Recommended Beginner Portfolio (2026 Special)

If you are starting SIP for the first time:

| Category | Fund Name | Monthly SIP |

|---|---|---|

| Flexi Cap | Parag Parikh Flexi Cap | ₹1,000 |

| Large Cap | Mirae Asset Large Cap | ₹500 |

| Hybrid | HDFC Hybrid Equity | ₹500 |

| Small Cap (Optional) | SBI Small Cap | ₹500 |

Total = ₹2,000 per month

This is the perfect starter combination.

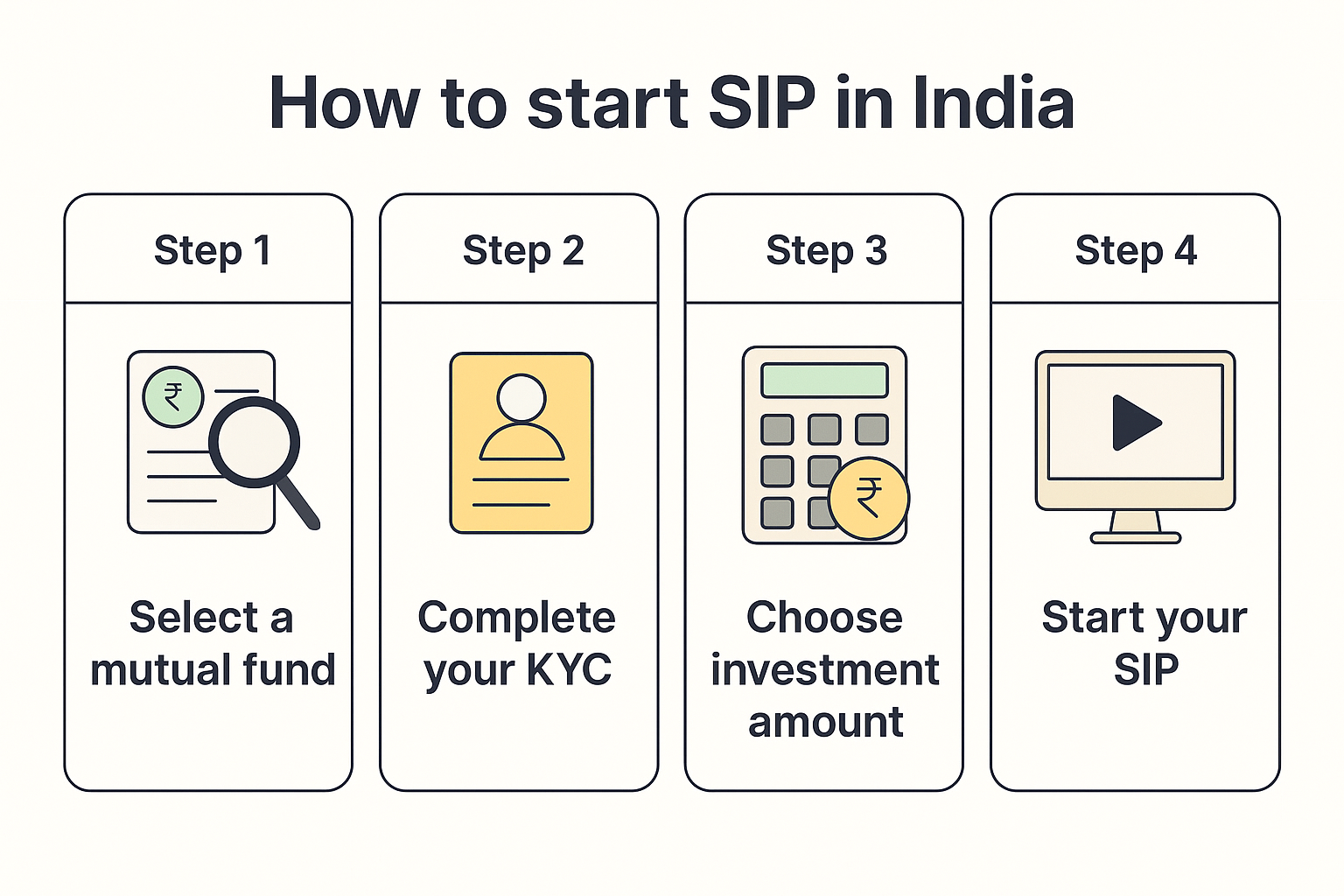

🪜 Step-by-Step Guide: How to Start SIP in 2026

Step 1: Choose an app

Recommended: Groww, ET Money, Zerodha, Paytm Money.

Step 2: Complete KYC

Takes 5 minutes online.

Step 3: Select your fund

Choose from the list above.

Step 4: Select SIP amount

Even ₹500 is perfect.

Step 5: Choose date

Prefer 1st, 5th, or 10th of the month.

Step 6: Set auto-pay

Avoid missing SIPs.

⚠️ Common Beginner Mistakes (And How to Avoid Them)

❌ Stopping SIP during market crashes

👉 Truth: Crash is when wealth is built.

❌ Choosing too many funds

Stick to 2–4 funds.

❌ Investing without goal

Define:

- Wealth

- House

- Marriage

- Retirement

❌ Checking daily NAV

Not needed. Not helpful. Not healthy.

📊 Comparison Table – Which SIP Is Right for You?

| Risk Level | Best Fund | Why Choose It |

|---|---|---|

| Very Safe | HDFC Hybrid Equity | Stability |

| Safe | Mirae Asset Large Cap | Low volatility |

| Moderate | Parag Parikh Flexi Cap | Balanced growth |

| High | Kotak Midcap | Higher returns |

| Very High | SBI Small Cap | Long-term wealth |

👨👩👧 Real-Life Indian Stories

⭐ Story 1: The 22-Year-Old Who Started with ₹500

Arjun started a ₹500 SIP in Parag Parikh flexi cap during college.

After 4 years, he had saved enough to buy a new laptop without EMI.

He told me:

“That SIP felt like my silent friend growing in the background.”

⭐ Story 2: The Mother Saving for Her Daughter

Priya, a 32-year-old single mom, started 3 SIPs:

- Mirae Large Cap

- HDFC Hybrid

- SBI Small Cap

She now has a clear 10-year plan for her daughter’s education.

⭐ Story 3: The Couple Preparing for Financial Freedom

Naveen & Shreya started with just ₹1500 SIP.

Today they invest ₹12,000/month and are on track for early retirement.

🛠️ Best Tools & Apps

⭐ Groww

Easy interface, perfect for beginners.

Why I recommend it: Zero clutter, clean charts.

⭐ ET Money

Goal-based investing.

Perfect for: Families planning education or retirement.

⭐ Zerodha Coin

Direct mutual funds at lowest expense ratio.

Best for: Serious long-term investors.

🔗 Internal Linking Suggestions

- /mutual-funds-for-beginners-india

- /how-to-start-sip-step-by-step

- /best-investment-options-india

- /financial-planning-for-indian-families

🔗 External Authoritative Links

- RBI: https://www.rbi.org.in

- AMFI: https://www.amfiindia.com

- SEBI: https://www.sebi.gov.in

❤️ Final Thoughts

If you’re reading this, it means you genuinely want to build a better future.

And that itself puts you ahead of 90% of India.

Money doesn’t grow by accident.

It grows because you take small, consistent steps — month after month.

A SIP is not just an investment.

It’s a promise you make to your future self.

Start small.

Start today.

Even ₹500 is enough to rewrite the next 10 years of your life.

❓ FAQs

Which is the best sip for beginners india in 2026?

Parag Parikh Flexi Cap + Mirae Asset Large Cap + a Hybrid fund.

Can I start SIP with ₹500?

Yes! SIPs were designed for ₹500 beginners.

Which app is best to start SIP in India?

Groww, ET Money, Zerodha, Paytm Money.

Is SIP risky for beginners?

Only if you stop early. Long-term SIP is safe.

Can I pause or increase SIP later?

Yes, all apps allow pausing, skipping, or increasing.

Which SIP gives highest return?

Historically: Small cap and mid cap funds (but higher risk).

Leave a Reply