📌 PERSONAL FINANCE: A REAL-WORLD GUIDE FOR INDIANS WHO WANT CONTROL, CONFIDENCE & FREEDOM

Most of us grow up learning algebra, trigonometry, and chemical equations…

but nobody teaches us how to manage money.

And because nobody teaches us, we learn about money through accidents:

-

The first loan we take

-

The credit card bill we didn’t expect

-

The EMI we regret

-

The investment we made because someone else recommended it

-

The fear of checking our bank balance at the end of the month

But here’s the truth most people never hear:

👉 Personal Finance isn’t about money.

It’s about choices, freedom, and peace of mind.

And the good news is — it’s learnable. Anyone can master it.

This guide is the roadmap I wish every Indian had in their early 20s.

Whether you’re earning ₹20,000 or ₹2,00,000 — the rules of money remain the same.

Let’s start at the beginning.

1. Why Personal Finance Matters More Today Than Ever Before

Our parents lived in a world where:

-

Jobs were stable

-

People stayed in the same company for decades

-

Medical costs were low

-

Pensions were common

-

School fees were affordable

That world is gone.

Today:

-

EMIs run our life

-

Medical bills can wipe out savings

-

Inflation quietly eats our money

-

Housing is expensive

-

Financial scams are everywhere

-

Nobody will save for your retirement except you

So personal finance is not optional — it’s a survival skill.

But the beauty is this:

👉 Once you understand money, life becomes lighter.

You feel in control, and the future stops feeling scary.

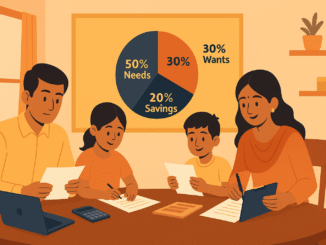

2. The 50-30-20 Rule: The Simplest Way to Control Your Money

Let’s start with the foundation — your monthly income.

Most people let money flow like water without knowing where it’s going.

But the 50-30-20 rule gives you structure:

✔ 50% Essentials

Rent, groceries, electricity, gas, school fees, phone bills.

✔ 30% Lifestyle

Food delivery, shopping, movies, travel, hobbies.

✔ 20% Savings + Investments

This is your future wealth.

If the percentages don’t fit your life, adjust them.

The goal isn’t perfection — it’s awareness.

Because when you control your money, you control your life.

3. The Emergency Fund: Your Safety Net in a Dangerous World

Life has a way of surprising us at the worst time:

-

Job loss

-

Medical emergency

-

Sudden repair

-

Family crisis

These events don’t wait for your bank balance.

That’s why an emergency fund is the first thing every Indian must build.

How much?

✔ At least 3–6 months of essential expenses.

Where to keep?

✔ Liquid fund

✔ High-interest savings account

✔ Short-term debt fund

Not in the stock market.

Not in crypto.

Not in FD with penalties.

Your emergency fund is your financial seatbelt.

You hope you never need it — but you’re grateful when you do.

4. The Real Meaning of Saving: It’s Not What You Think

Most people think saving means “cutting expenses.”

That’s one part of it, but not the most important part.

Saving means:

-

Choosing peace of mind over impulse buying

-

Avoiding lifestyle inflation

-

Saying NO to things that don’t add joy

-

Planning for opportunities

-

Preparing for setbacks

When you save, you’re not restricting yourself.

You’re giving your future self freedom.

5. Why Investing Is Not Optional Anymore

If your money is sitting idle, inflation is slowly and silently destroying it.

For example:

₹10,000 in 2000

= ₹2,350 in today’s value (because of inflation)

You don’t feel it immediately, but it happens.

Investing is how you fight inflation.

Investing is how you grow wealth.

Investing is how ordinary people become financially independent.

The safest and simplest investment for beginners:

✔ Mutual Funds (SIP)

✔ Index Funds

✔ Sovereign Gold Bonds

✔ PPF for guaranteed long-term savings

✔ Direct stocks (only after learning)

You don’t need to pick the “best” investment.

You just need to pick one good investment and stay consistent.

6. Bad Debt vs Good Debt: The Truth Most Indians Learn Too Late

Not all debt is bad.

But all unplanned debt is dangerous.

✔ Good Debt

-

Home loan

-

Education loan

-

Business loan

These build your long-term value.

❌ Bad Debt

-

Credit card outstanding

-

Personal loan for lifestyle

-

BNPL apps

-

EMI for expensive gadgets

These trap you.

Debt isn’t just a financial burden.

It’s an emotional burden — it drains your peace, confidence, and mental space.

Your goal should always be:

👉 Manage debt. Don’t let debt manage you.

7. Credit Score: Your Financial Reputation

People say, “I don’t care about credit score.”

But you should.

Because your credit score decides:

-

Whether you get a loan

-

How much interest you pay

-

Whether banks trust you

-

Whether you get a credit card

How to improve CIBIL score:

✔ Pay every EMI and bill before the due date

✔ Keep credit card usage below 30%

✔ Don’t take loans unnecessarily

✔ Keep your oldest card active

A good credit score saves money.

A bad score costs money.

8. Insurance: The Most Ignored but Most Important Part

Ask any middle-class family:

Medical emergencies hurt more financially than emotionally.

One hospital visit can burn through years of savings.

That is why insurance exists.

Must-have for every Indian:

✔ Health insurance (₹5–10 lakh cover)

✔ Term life insurance (if you support your family)

✔ Personal accident cover

Not ULIPs.

Not money-back plans.

Not endowment policies.

Insurance is not an investment — it’s protection.

9. Taxes: Keep More of What You Earn

Indians work hard for money.

But most don’t know how to protect it.

Use these tools wisely:

-

80C (ELSS, PPF, EPF, NPS)

-

80D (health insurance)

-

HRA

-

Capital gains strategies

-

NPS tier-1 tax benefits

Tax planning is not about saving every rupee.

It’s about being smart with your money.

10. Retirement Planning: The Earlier You Start, the Richer You Retire

Your parents had pensions.

You won’t.

Your retirement depends on your decisions.

Start a SIP of even ₹2,000 per month.

Increase it by 10% every year.

The number looks small now…

but after 25–30 years, it becomes massive.

The math of compounding is magical — if you start early.

11. Your Money Mindset: The Hidden Driver of Wealth

Money is emotional.

And our mindset shapes every financial decision we make.

A few truths worth remembering:

-

Wealth grows slowly, then suddenly

-

Comparison kills happiness

-

Discipline beats intelligence

-

Consistency beats perfection

-

Rich is not the one who earns more

-

Rich is the one who needs less

Personal finance is not about income.

It’s about behavior.

12. Tools, Apps & Systems to Simplify Your Financial Life

These tools can turn chaos into clarity:

✔ Budgeting

-

Jupiter

-

Fi

-

Moneyview

-

Walnut

✔ Investing

-

Groww

-

Zerodha

-

Coin

-

ETMoney

✔ Credit score

-

OneScore

-

CRED

✔ Tracking

-

INDmoney

-

Monefy

Simple tools can change your financial life.

Final Thoughts: You Deserve Financial Peace

Money is not everything, but it affects everything that matters:

-

Health

-

Happiness

-

Relationships

-

Freedom

-

Future

-

Confidence

When you learn how to handle money, you unlock a calmer, stronger version of yourself.

Your personal finance journey doesn’t need to be perfect.

It just needs to start.

This category on your website will guide readers through:

-

Budgeting

-

Saving

-

Investing

-

Debt management

-

Credit score

-

Financial habits

-

Retirement planning

-

Tools

-

And real-life money wisdom

This is not just information —

it’s a path to financial independence.