Last year, my cousin Ramesh finally decided to invest in the stock market.

Salary credit came. Bills paid. A little money left.

He opened Google… and froze.

Groww. Zerodha. Upstox.

Three apps. Millions of users. Endless YouTube opinions.

“Which one is safe?”

“Which one is easy?”

“What if I make a mistake?”

If you’ve ever felt this confusion, you’re not alone.

In fact, groww vs zerodha vs upstox 2026 is one of the most common questions Indians ask before opening their first Demat account today.

Because this decision isn’t just about an app.

It’s about trust.

Your hard-earned money.

And peace of mind.

Let’s break this down calmly, honestly, and practically — like a friend who’s already walked this path.

That’s why this Groww vs Zerodha vs Upstox 2026 comparison is designed to help Indian beginners, professionals, and families choose the right platform with confidence.

Groww vs Zerodha vs Upstox

Groww vs Zerodha vs Upstox 2026: Detailed Comparison for Indians

Here’s the truth most people don’t realize.

All three — Groww, Zerodha, and Upstox — are SEBI-registered brokers.

All are safe.

All allow you to invest in stocks, mutual funds, ETFs, IPOs, and more.

The real difference is not safety.

It’s experience, simplicity, and suitability.

Think about this:

- A college student investing ₹500 a month

- A salaried professional trading after office hours

- A family planning long-term wealth

They don’t need the same app.

That’s where this comparison matters.

Why This Comparison Matters in the Indian Reality (2026)

India is no longer a “FD-only” country.

- UPI made money digital

- Apps like PhonePe, Groww, and Zerodha made investing normal

- Families now discuss SIPs at dinner tables

But with opportunity comes confusion.

Common Indian Problems:

- Fear of losing money

- Over-trading due to complex apps

- Hidden charges shock

- Poor customer support during critical moments

Choosing the wrong platform doesn’t just cost money — it costs confidence.

Step-by-Step — How to Choose the Right Trading App

Step 1: Be honest about yourself

Ask:

- Am I a beginner or active trader?

- Long-term investor or short-term trader?

- Mobile-only or desktop user?

Step 2: Check simplicity first

If the app confuses you, you’ll stop investing.

Step 3: Understand charges clearly

Brokerage looks small. It adds up silently.

Step 4: Check ecosystem

Reports, education, support, integrations matter.

Groww vs Zerodha vs Upstox — Detailed Comparison (2026)

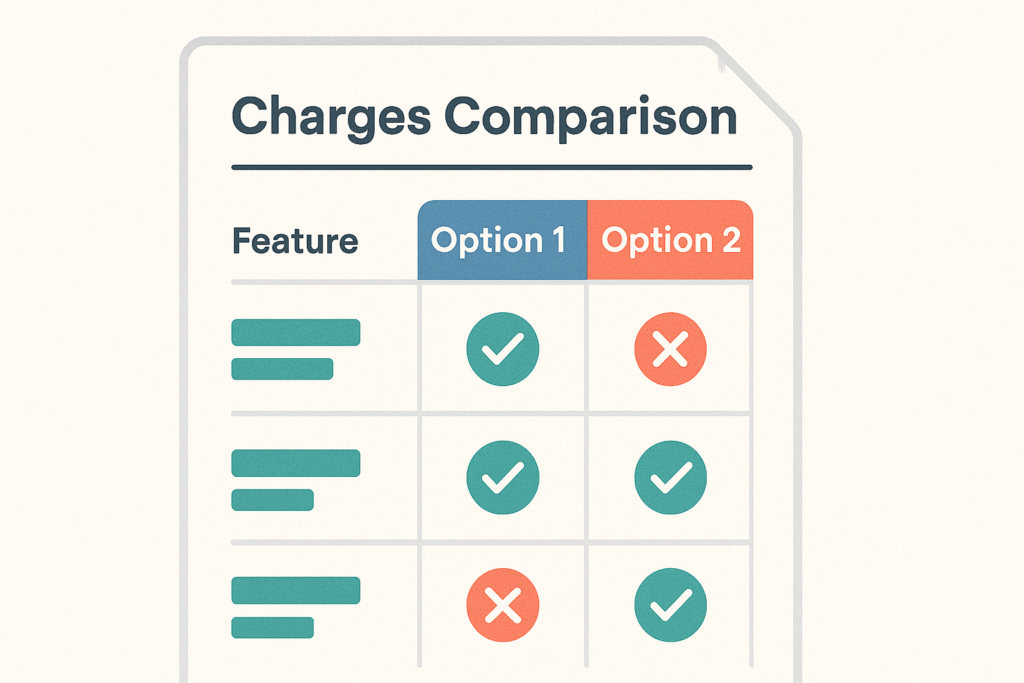

📊 Core Comparison Table

| Feature | Groww | Zerodha | Upstox |

|---|---|---|---|

| Best For | Beginners & families | Serious traders | Active traders |

| Account Opening | Free | ₹200 | Free |

| Equity Delivery | ₹0 | ₹0 | ₹0 |

| Intraday | ₹20/order | ₹20/order | ₹20/order |

| App Simplicity | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐ |

| Reports & Insights | Basic | Advanced | Moderate |

| Support Quality | App-based | Ticket system | Mixed |

| Learning Curve | Very low | Medium | Medium |

In this Groww vs Zerodha vs Upstox 2026 breakdown, the differences become clear once you match each platform to your investing style.

Groww — Why Beginners Love It

Groww feels like Amazon for investing.

Clean. Calm. Non-intimidating.

Pros:

- Best UI for first-time investors

- Excellent for mutual funds & SIPs

- Zero confusion screens

Cons:

- Limited advanced trading tools

- Not ideal for professional traders

Best for:

Students, salaried professionals, Indian families starting wealth journeys.

Zerodha — The Professional’s Platform

Zerodha is powerful, not pretty.

And that’s intentional.

Pros:

- Industry-leading tools (Kite, Coin, Console)

- Best for active traders

- Strong education via Varsity

Cons:

- Steep learning curve

- UI can overwhelm beginners

Best for:

Serious traders, F&O users, experienced investors.

Upstox — Balanced but Aggressive

Upstox sits between Groww and Zerodha.

Pros:

- Fast execution

- Better trading tools than Groww

- Competitive UI upgrades

Cons:

- Support inconsistency

- Not as beginner-friendly as Groww

Best for:

Users moving from beginner to intermediate level.

Real-Life Indian Stories

Story 1: College Student (₹1,000 SIP)

Ananya, 21, used Groww.

Why? She understood it instantly.

No fear. No jargon.

Story 2: IT Professional

Rahul switched from Groww to Zerodha.

He needed charts, indicators, precision.

Story 3: Family Investor

A middle-class couple chose Groww for SIPs and Zerodha for trading.

Yes — you can use more than one app.

Common Mistakes Indians Make (And How to Avoid Them)

❌ Choosing based on ads

❌ Ignoring charges

❌ Over-trading due to excitement

❌ Not understanding risk

Pro Tip:

Your first app should reduce anxiety, not increase dopamine.

Tools, Apps & Resources (Affiliate-Friendly)

Here’s what genuinely helps:

- Groww → Calm investing, SIPs, beginners

- Zerodha → Trading, analysis, discipline

- Upstox → Fast trades, evolving tools

Pair these with:

- ET Money for planning

- Smallcase for theme investing

- Fi / Jupiter for smart banking

Choose tools that solve stress, not add features.

Final Thoughts

If you’re reading this, you care about your money.

That already puts you ahead.

The best app is not what YouTubers shout about.

It’s what lets you sleep peacefully at night.

Start simple.

Stay consistent.

Upgrade only when needed.

Ultimately, the right choice in the Groww vs Zerodha vs Upstox 2026 debate depends on your experience level, goals, and comfort with technology.

That’s how wealth is built in India — quietly.

🔗 Internal & External Linking Suggestions

Internal Links:

- Beginner’s Guide to Stock Market in India

- SIP vs Lumpsum Explained

- Best Budgeting Apps in India

- How to Build Long-Term Wealth

External Links:

FAQs

Groww vs Zerodha vs Upstox 2026 — which is safest?

All are SEBI-regulated and equally safe.

Which is best for beginners?

Groww, without question.

Which app is best for trading?

Zerodha for serious traders.

Can I open multiple Demat accounts?

Yes, legally allowed in India.

Which has lowest charges?

All are similar for delivery; trading costs differ by usage.

Is Zerodha good for long-term investors?

Yes, if you’re comfortable with the interface.

Which app should families choose?

Groww for SIPs + Zerodha for advanced needs.

Leave a Reply