Rohan still remembers the day he wanted to buy his first stock.

It was a normal Tuesday evening. He had just returned from work, tired, scrolling Instagram, when he saw a post saying:

“If you had invested ₹10,000 in Asian Paints in 2000, it would be worth lakhs today.”

His heart sank a little.

He whispered to himself, “Yaar, I wish someone had taught me this earlier.”

He opened Google and typed how to buy stock india — only to find complicated jargon, confusing terms, and advice that felt written for people sitting inside a corporate boardroom.

But here’s the truth…

Most Indians WANT to start investing.

They WANT to buy their first stock.

They WANT to grow wealth.

But they are scared.

Not because the stock market is risky…

But because no one explained it to them in simple, human language.

And that’s exactly what this guide will do.

Forget fancy jargon.

Forget technical textbook definitions.

This is the guide I wish every Indian — student, parent, professional, homemaker — had before buying their first stock.

So breathe easy.

You’re about to learn this step-by-step, just like a friend explaining over chai.

If you’re searching for how to buy stock India in the simplest way possible, this guide will walk you through every step

📘 How to Buy Your First Stock in India

🔷 Understanding How to Buy Stock in India

Let’s break this down in the simplest way possible.

Buying a stock is NOT complicated.

If you’ve ever used Amazon, Flipkart, or Swiggy, you already understand half of the process.

A stock is simply a tiny ownership slice of a company.

When you buy:

- 1 share of Reliance → you own a tiny part of Reliance

- 1 share of IRCTC → you own a tiny part of IRCTC

- 1 share of Asian Paints → you own a tiny part of Asian Paints

That’s it.

No rocket science.

But here’s where beginners get overwhelmed:

- Too many apps

- Too many new terms

- Too many opinions from friends/YouTube

If you are confused about how to buy stock India as a complete beginner, don’t worry — this guide makes it simple.

🔷 Why Learning This Matters

Most people don’t realize this…

India is going through the biggest wealth-creation era in its history.

👉 More first-time investors

👉 Large young population

👉 Digital demat accounts

👉 Zero-commission brokerages

👉 Thriving companies

👉 Growing middle-class investing culture

Your parents grew wealth through:

- Fixed deposits

- Gold

- Real estate

Your generation will grow wealth through:

- Stocks

- Index funds

- ETFs

- SIPs

- Digital investing

If you don’t learn this now, you will watch others grow while you stay stuck.

Here’s a real example.

Story:

Sneha, a school teacher from Pune, invested ₹5,000 every month into stocks and ETFs since 2020 using Groww.

By 2025, her portfolio crossed ₹3.8 lakhs.

She told me, “I wish I started earlier. I didn’t know it was THIS simple.”

That’s the power of starting.

And today, you will take your first step too.

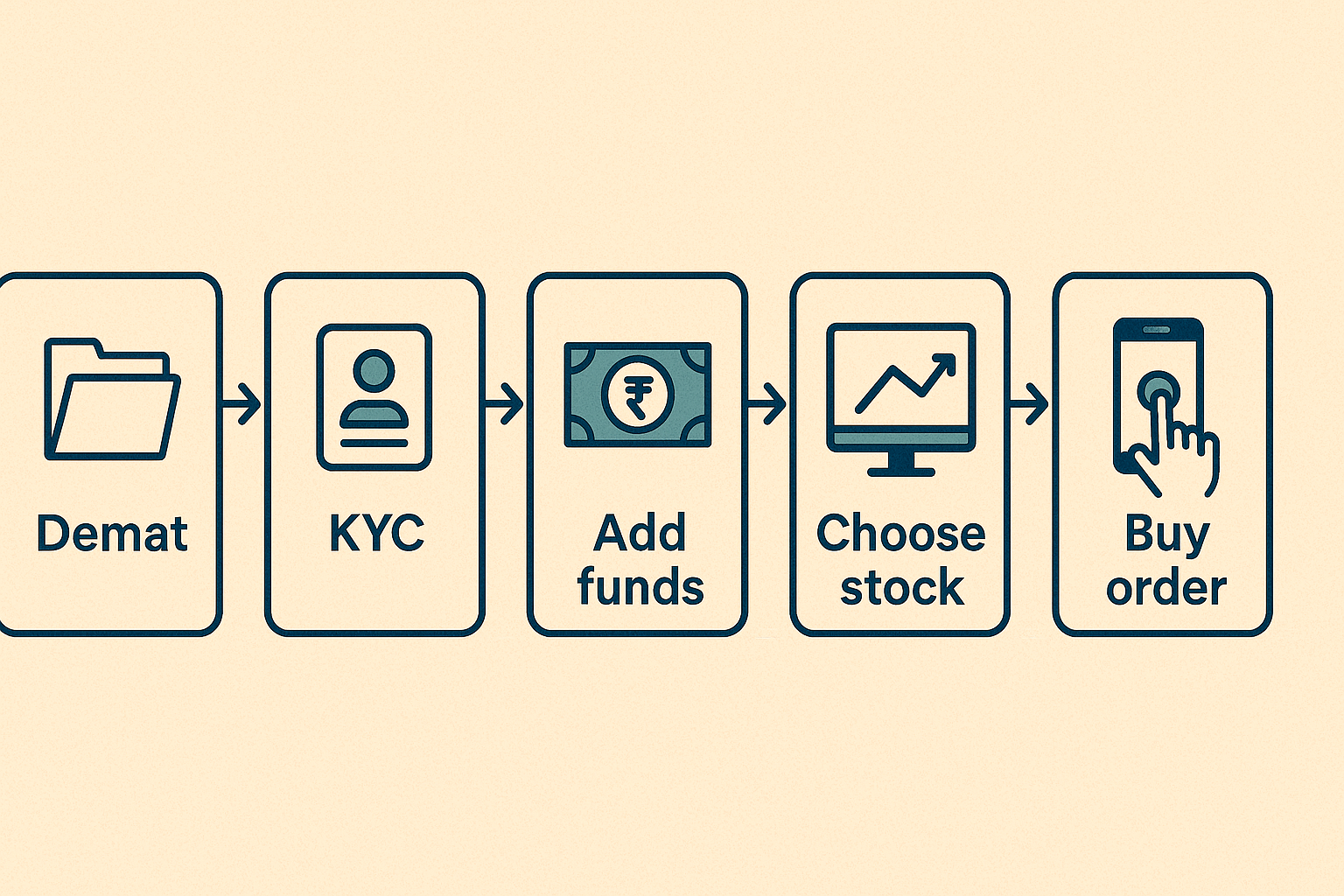

🔷 Step-by-Step Guide — How to Buy Stock in India

This is the MOST important part.

Follow these steps exactly.

Most beginners who ask how to buy stock India get confused by too much jargon, so here’s the simplest explanation.

Step 1 — Choose a Trusted Demat + Trading App

A Demat account holds your stocks.

A trading account helps you buy/sell.

Most modern apps give both together.

Popular Indian Platforms

| Platform | Why It’s Good for Beginners | Charges |

|---|---|---|

| Groww | Simple interface, 10-min onboarding | ₹0 account opening |

| Zerodha | Most trusted, powerful charts | Very low brokerage |

| Upstox | Fast, clean UI | Free account |

| Paytm Money | Easy for absolute beginners | Discount brokerage |

| Angel One | Good advisor tools | Free account |

Pro Tip:

Pick ONE app and stick with it for at least 6 months.

Constant switching causes confusion.

Step 2 — Complete KYC (5–10 Minutes)

You will need:

- Aadhaar

- PAN card

- Bank details

- Signature scan

Most apps complete KYC in 5–10 minutes.

Once approved, you’re ready to buy your first stock.

Step 3 — Add Funds (Start Small)

Don’t start with a big amount.

Even ₹500–₹1,000 is enough to make your first purchase.

Remember, buying your FIRST stock is about:

- Confidence

- Learning

- Experience

Not profits.

Step 4 — Choose Your First Stock (The Smart Way)

Avoid:

❌ Penny stocks

❌ Hot tips

❌ YouTube hype

❌ Speculation

❌ “Guaranteed profit” calls

Instead, start with:

✔ Stable companies

✔ Clear business models

✔ Easy-to-understand brands

✔ Companies you use daily

Examples:

- Asian Paints

- HDFC Bank

- Titan

- TCS

- Marico

- IRCTC

If you can explain the business to a 10-year-old, you can invest in it.

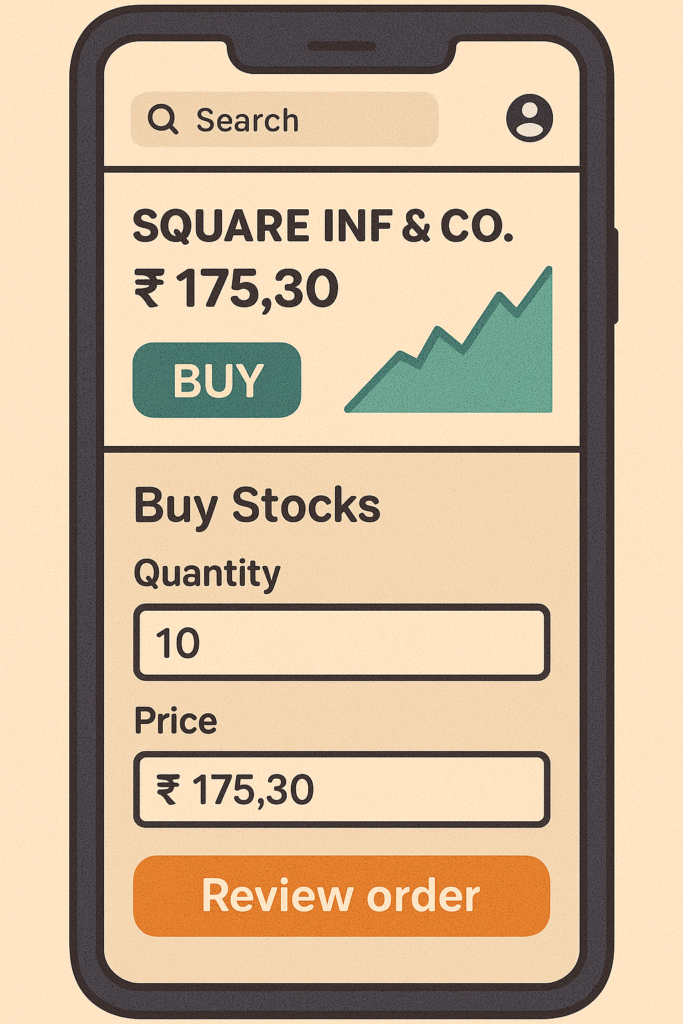

Step 5 — Place Your First Buy Order

Inside your app:

- Search the company name

- Click “Buy”

- Choose quantity (e.g., 1 share)

- Choose order type → always start with Market Order

- Click Buy

Congratulations.

You just became a shareholder.

Step 6 — Track, Learn, Improve

Don’t check your app 10 times a day.

It creates anxiety.

Instead:

- Track weekly

- Read company news

- Understand basics of market

- Stay invested

Wealth comes to those who stay patient.

🔷 Tips, Mistakes & Pro Secrets

One of the biggest mistakes beginners make when learning how to buy stock India is following random tips.

Here are the mistakes 90% beginners make:

Mistake 1 — Buying Based on Tips

If your friend, neighbor, or random Telegram channel tells you to buy a stock… DON’T.

You are risking YOUR money on someone else’s half-baked conviction.

Mistake 2 — Expecting Fast Profits

Stocks move like a heart rate monitor — up and down.

Long-term is where real wealth lies.

Mistake 3 — Not Diversifying

Don’t buy only 1–2 companies.

Spread across:

- Banking

- FMCG

- Tech

- Pharma

- Auto

Pro Secret — 3 Stock Formula for Beginners

Start with:

- 1 Large Cap Stock (HDFC Bank, Infosys)

- 1 Consumption Stock (ITC, Asian Paints, Titan)

- 1 Index ETF (Nifty 50 or Sensex ETF)

This gives:

✔ Stability

✔ Growth

✔ Low risk

✔ Learning experience

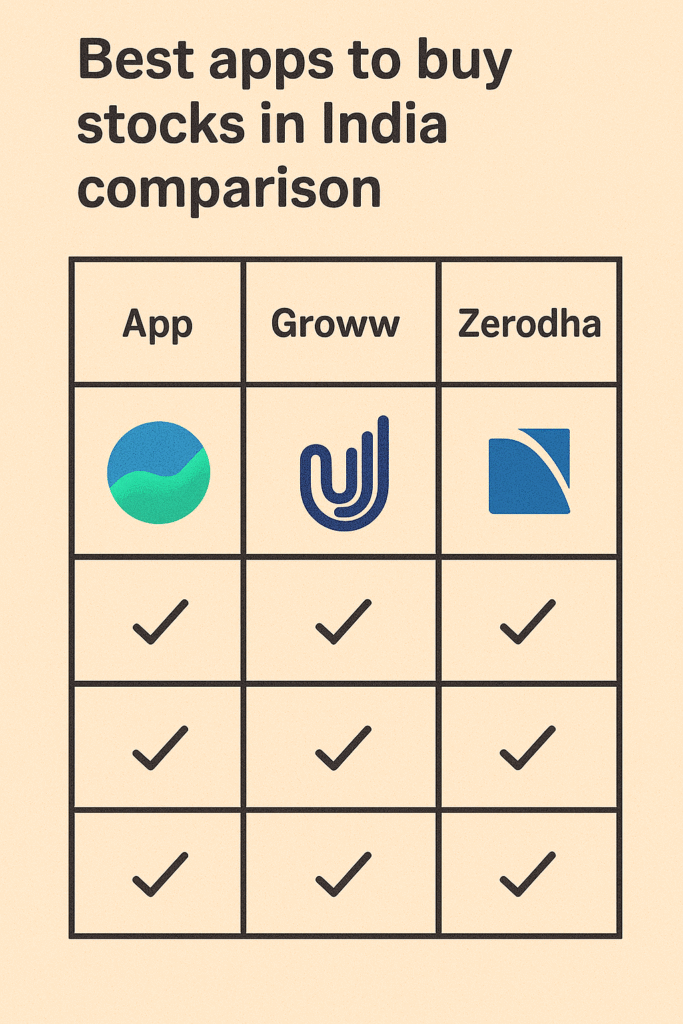

🔷 Comparison Table — Best Apps for Buying Stocks in India

| Feature | Groww | Zerodha | Upstox | Angel One |

|---|---|---|---|---|

| Ease of Use | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ |

| Best For | Beginners | Active traders | Students | Long-term |

| Account Opening | Free | Low cost | Free | Free |

| Research Tools | Medium | High | Medium | High |

| Charges | Very low | Lowest | Low | Low |

🔷 Real-Life Stories That Show How Simple This Is

Story 1: The College Student

Aman, 19, bought his first stock — IRCTC — using ₹600 he saved from his part-time job.

When the stock went up by ₹48, he wasn’t excited because of the profit.

He said:

“It felt like I finally started my financial journey.”

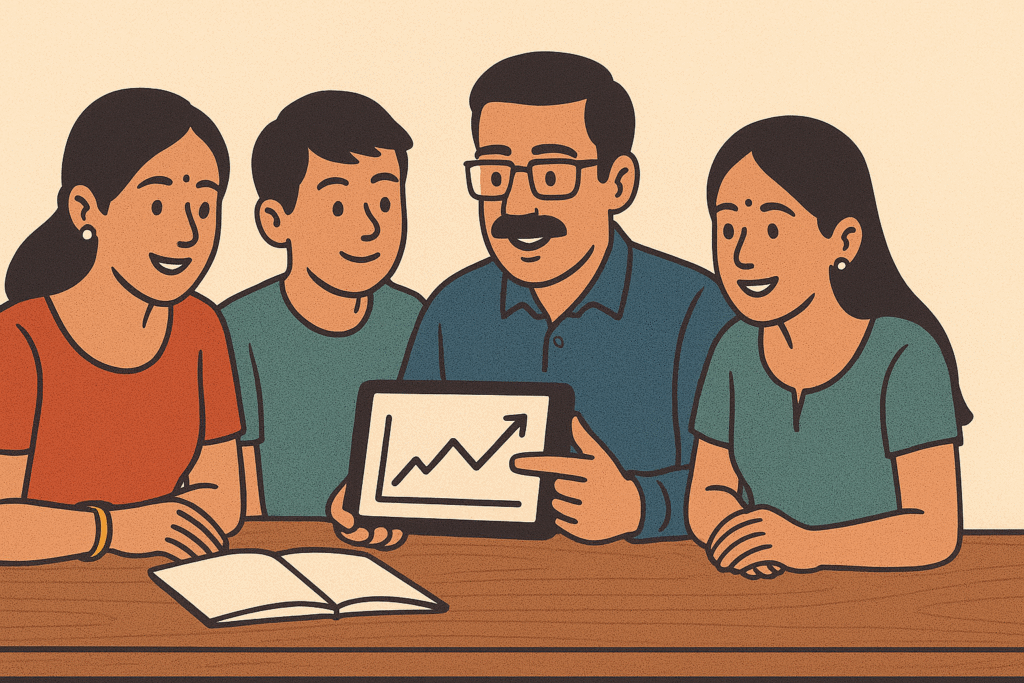

Story 2: The Working Mom

Lakshmi, 38, always thought the stock market was gambling.

Her son explained how Demat works.

She bought 2 shares of Titan.

Six months later, she said:

“I feel powerful. I feel like I control my money now.”

Story 3: The Beginner Professional

Arun, 27, started with a single share of HDFC Bank.

That one small decision changed everything.

Today he invests ₹4,000 SIP in stocks and ETFs monthly.

🔷 Tools, Apps & Resources

These are apps I personally recommend :

⭐ Groww (Beginner Friendly)

What I love:

- Clean UI

- Fast KYC

- Perfect for first-time buyers

- Easy stock research

Great for people who want ZERO complications.

⭐ Zerodha (For Serious Long-Term Investors)

Why it helped me:

- The most trusted broker in India

- Beautiful charts

- Ideal for disciplined investing

You can start here if you want high-quality research.

⭐ Upstox (Fast & Student-Friendly)

If speed matters to you, Upstox feels super smooth.

Many students prefer it because:

- Quick onboarding

- Modern UI

- Easy learning curve

Pros & Cons Table

| Platform | Pros | Cons |

|---|---|---|

| Groww | Simple, clean, beginner-friendly | Limited advanced charts |

| Zerodha | Best charts, stable, trusted | Slightly complex for newbies |

| Upstox | Fast, smooth, great UI | Research tools not as strong |

| Angel One | Good research & advisory | Too many features for beginners |

🔷 Final Thoughts

Let me tell you something simple yet powerful.

Your first stock is not about money.

It’s about identity.

It’s the moment you stop being someone who wishes…

And become someone who acts.

Every investor you admire — from Rakesh Jhunjhunwala to your financially smart colleague — once bought their first share with doubt, fear, and a racing heart.

Today, it’s your turn.

Start small.

Stay patient.

Learn slowly.

Invest consistently.

The moment you buy your first stock, your financial life will change forever.

And I’m proud of you for taking this step. ❤️

🔗 Internal & External Linking Suggestions

Internal Links

- Beginner Guide to SIPs in India

- How to Understand Stock Market Basics

- Best Apps for Investing in India

- Stock Market Terms Explained

- Index Funds vs Stocks Guide

External Authoritative Links

- SEBI Official: https://www.sebi.gov.in

- RBI: https://www.rbi.org.in

- NSE India: https://www.nseindia.com

FAQs

How to buy stock in India as a complete beginner?

Just open a Demat account, complete KYC, add funds, and buy your first share. Start small — even ₹500 is enough.

What is the minimum amount needed to buy stocks?

There is no minimum. You can buy even one share of a company.

Which app is best for beginners to buy stocks?

Groww and Upstox are easiest. Zerodha is great if you want advanced features.

Should beginners invest in penny stocks?

No. They are extremely risky and can fall to zero.

Is buying stocks safe in India?

Yes — as long as you’re using SEBI-registered brokers like Groww, Zerodha, Upstox, Paytm Money, or Angel One.

How many stocks should a beginner buy?

Start with 2–3 stable companies + 1 index ETF.

Can I lose money in the stock market?

Short term, yes.

Long term, historically, Indian markets have grown strongly.

Leave a Reply