Some financial journeys begin with a jackpot.

Most begin with ₹500 and a little fear.

If you’re searching for “sip for beginners India”, you’re probably standing at that crossroads — where your salary comes in, expenses eat half of it, and you wonder, “Will I ever be able to save enough for my dreams?”

I’ve been there.

I remember sitting in a tiny rented room in Chennai, looking at my bank balance, confused about where people even started with investing. Mutual funds sounded too complicated. SIP felt like a big commitment. And honestly… I was scared of losing money.

But here’s what I discovered — you don’t need to be rich, smart, or financially “perfect” to start a SIP.

You just need to start.

This guide will walk you through everything, in simple, emotional, human language — the kind you can explain to your parents without sounding like a finance professor.

Grab a cup of coffee.

Let’s build your financial foundation.

If you’re searching for a simple, confusion-free “sip for beginners India” guide, this article will help you start with confidence.

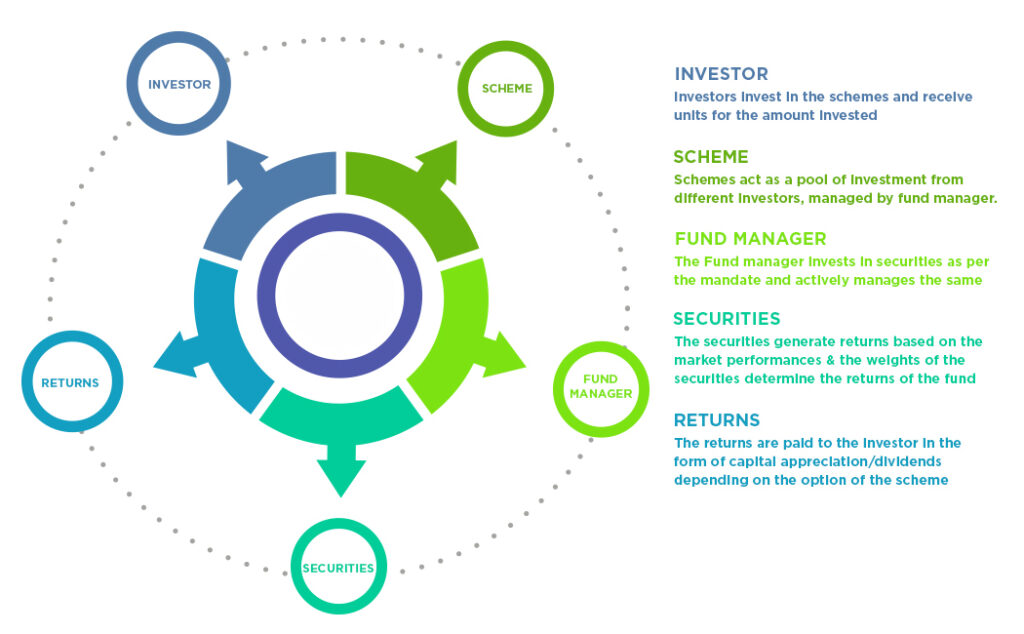

🧩 What Exactly Is SIP (For Absolute Beginners)?

This is the most trusted sip for beginners India framework because it explains SIP in a simple, real-life way.

A Systematic Investment Plan (SIP) is simply a fixed monthly investment into a mutual fund — usually starting from ₹100 or ₹500.

Think of it like:

- a recurring deposit

- but with higher growth potential

- and linked to the stock market

- automatically managed by fund experts

It’s like telling your money,

“Hey… go work for me every month.”

Why SIP Is The Best Starting Point in India (Especially in 2026)

Because:

- salaries aren’t rising fast

- expenses are rising faster

- inflation is eating our savings

- markets are volatile

- but long-term wealth needs consistency

SIP solves all of these.

You don’t need timing.

You don’t need huge money.

You just need discipline.

🌱 How SIP Works (Explained With a Simple Indian Example)

Most sip for beginners India investors don’t understand rupee-cost averaging — this example makes it clear.

Imagine you start a ₹1,000 SIP in the Nifty 50 Index Fund on Groww.

- In January, NAV = ₹20 → you buy 50 units

- In February, NAV = ₹18 → cheaper units → you buy 55 units

- In March, NAV = ₹22 → you buy 45 units

Even if markets go up and down, your cost averages out.

This is called rupee-cost averaging.

SIP Works Because of Three Superpowers

1. Compounding

Your returns also start generating returns.

2. Averaging

You buy more when markets fall (best time to buy).

3. Discipline

You invest without overthinking.

Together, they turn small amounts into big wealth.

📊 How Much Should a Beginner Invest in SIP?

If you’re using this sip for beginners India guide for planning, start with a small amount and increase yearly.

Most Indians start with ₹500–₹2,000.

Professionals start with ₹5,000–₹10,000.

Families often run 4–8 SIPs for different goals.

Quick Formula

Ideal SIP Amount = 20% of Monthly Savings

If you can save ₹10,000/month → SIP = ₹2,000

If you can save ₹5,000/month → SIP = ₹1,000

Start small. Increase later.

🎯 Which SIP Should Beginners Start With in India? (2026 Updated)

Here’s the truth:

You don’t need 20 mutual funds.

You need 2–3 solid ones.

Beginner-Friendly Mutual Fund Types

| Category | Good For | Expected Returns | Risk Level |

| Index Funds | Beginners | 10–12% | Low–Moderate |

| Large Cap Funds | Safe growth | 11–13% | Moderate |

| ELSS (Tax-saving) | Tax + returns | 12–15% | Moderate–High |

| Hybrid Funds | New investors | 8–11% | Low–Moderate |

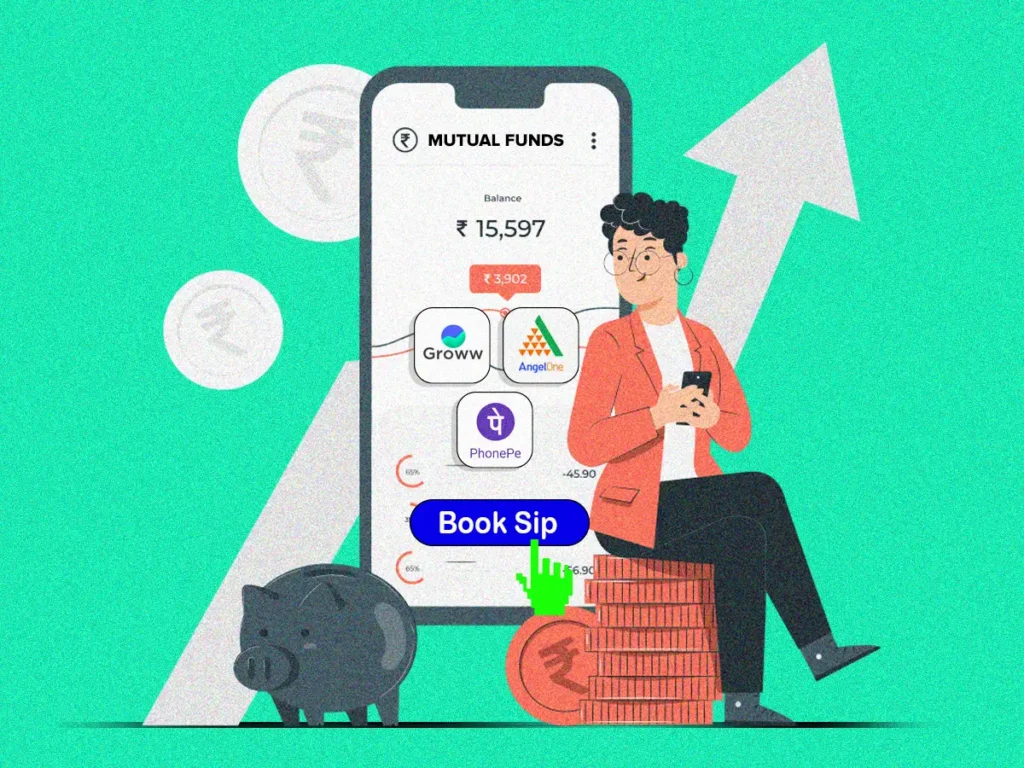

Best Apps to Start SIP in India

- Groww – clean design, easiest for beginners

- Zerodha Coin – advanced users, direct plans

- ET Money – excellent tracking

- Paytm Money – low-cost investing

- Jupiter / Fi – smooth UI + goal-based

🔍 Step-by-Step Guide: How to Start SIP for Beginners in India

Every sip for beginners India step becomes easier when you use apps like Groww or ET Money.

Step 1 — Choose a Goal

Examples:

- Emergency fund

- Child education

- Buying a car

- Retirement

- Home downpayment

Step 2 — Choose a Category

Pick 1–2 funds, not 5–10.

Step 3 — Complete KYC

KYC is now fully online:

- PAN

- Aadhaar

- Video verification

Step 4 — Start SIP

Depending on the app:

- Set amount

- Choose date

- Enable auto-debit

Step 5 — Track Every 3–6 Months

Not daily.

Not weekly.

Just once in a while.

📦 SIP for Beginners India — Real Examples You’ll Relate To

Example 1 — Meera, a 22-year-old student

Meera started with ₹500 SIP while doing her internship.

Today she invests ₹3,000/month.

Her confidence grew faster than her returns.

Example 2 — A middle-class Chennai couple

They started:

- ₹2,000 in Nifty Index

- ₹1,500 in ELSS

- ₹1,000 in Hybrid

Total = ₹4,500/month → Future home downpayment.

Example 3 — A Bangalore IT professional

Started ₹8,000/month

Increased by 10% every year.

That step-up SIP changed his life.

🧠 Common Mistakes Beginners Make (Avoid These)

A common sip for beginners India mistake is checking returns daily — avoid this.

- stopping SIP during market crashes

- investing blindly in “best funds list” posts

- choosing too many funds

- checking returns daily

- mixing direct and regular plans

- ignoring risk profile

- no emergency fund

Avoid these and you’re already ahead of 90% of new investors.

🌱 Comparison Table: SIP vs FD vs Recurring Deposit

For sip for beginners India users, SIP is safer than lumpsum during volatility.

| Feature | SIP | FD | RD |

| Returns | 10–14% (market-linked) | 6–7% | 5–6% |

| Risk | Moderate | Low | Low |

| Flexibility | High | Low | Medium |

| Good For | Long-term wealth | Short-term savings | Beginners saving fixed money |

| Inflation Beating | Yes | No | No |

Clear winner for long-term wealth: SIP.

💡 How Long Should a Beginner Continue SIP?

Most sip for beginners India plans create strong wealth when continued for 7–10+ years.

Here’s my honest answer:

- Minimum: 3 years

- Good: 5–7 years

- Best: 10–20 years

Wealth comes from time, not timing.

📈 SIP vs Lumpsum – Which Is Better for Beginners?

| Feature | SIP | Lumpsum |

| Best For | Beginners | Experienced investors |

| Risk | Lower | Higher |

| Market Timing | Not needed | Important |

| Emotion Control | Easy | Difficult |

| Flexibility | High | Low |

For beginners?

Start with SIP.

Shift to lumpsum later if needed.

🧮 SIP Calculator (Simple Manual Method)

Use any sip for beginners India calculator on Groww or ET Money to estimate your future value.

To estimate future value:

Future Value = SIP × [ (1 + R)^(N) – 1 ] / R × (1 + R)

Where:

R = monthly return

N = number of months

Example:

₹2,000 SIP for 10 years @ 12% approx = ₹4.6 lakh invested → ₹7.8 lakh corpus.

Use any free calculator:

Groww, Zerodha, ET Money have excellent ones.

Final Thoughts

If you’ve reached here, you’re serious about changing your financial life.

And honestly — that already puts you ahead of 90% of people.

Starting an SIP is not about money.

It’s about taking control.

It’s about giving your future a chance.

It’s about building something your family can depend on.

Start small.

Stay consistent.

Let time do the magic.

If you need guidance choosing your first SIP or app, check my next guide:

“Best SIP Funds for Beginners in India (2026)”

You’re on the right path.

And I’m genuinely proud of you.

SIP for Beginners India

🛠 The Tools That Actually Help Beginners

Every sip for beginners India investor can start easily with apps like Groww or Zerodha Coin.

Groww App

- simple

- safe

- good for students and new earners

Zerodha Coin

- lowest cost

- for serious long-term investors

ET Money

- best goal tracking

- excellent SIP increasing tools

If your goal is zero confusion, start with Groww.

If your goal is lowest expense ratios, pick Coin.

🔗 Internal Linking Suggestions

- What Are Mutual Funds? Beginner Guide

- Index Funds India (2026 List & Explained)

- How to Save Money in India (Practical Blueprint)

- Best Investment Apps India

- Tax-Saving for Beginners (ELSS Guide)

🔗 External Authoritative Links

FAQs

If you type “sip for beginners India”, you’ll find that most experts recommend index funds.

Can I start SIP with just ₹500?

Absolutely. Most Indians start small. It builds the habit.

Which SIP is best for beginners?

Start with index funds or large-cap funds. Simple. Stable. Beginner-friendly.

Should I stop SIP during market crash?

No. That’s when you get the best units at cheap rates.

How long should I run a SIP?

Ideally 5–10 years. More time = more compounding.

Is SIP safe?

SIP reduces risk, but mutual funds still depend on the market. Long-term investing keeps it safe.

Which app should I use?

Groww for simplicity, Zerodha for lowest cost, ET Money for smart tracking.

Can I withdraw SIP anytime?

Yes, except ELSS which has a 3-year lock-in.

Leave a Reply