Ravi still remembers that evening in 2020.

He had just received a bonus of ₹1.5 lakh. His colleague said, “Put it as a lump sum. Market is low.”

His cousin said, “No yaar, SIP is safer.”

Ravi did what most Indians do.

He opened YouTube.

Then Google.

Then WhatsApp groups.

And ended up more confused than before.

If you’re reading this, chances are you’ve asked the same question: sip vs lump sum India — which is actually better?

This isn’t just an investment doubt.

It’s an emotional one.

Because behind that question is fear of losing money, hope of growing wealth, and the pressure of “doing the right thing” for your family.

Here’s the truth: there is no one-size-fits-all answer.

But there is a right answer for you.

Let’s break this down calmly, practically, and honestly—using real Indian examples, not textbook jargon.

SIP vs Lump Sum

Understanding SIP vs Lump Sum India (In Simple Words)

Before opinions, let’s get clarity.

What Is SIP?

A Systematic Investment Plan (SIP) means investing a fixed amount (₹500, ₹1,000, ₹5,000, etc.) at regular intervals—usually monthly—into a mutual fund.

Think of SIP like your EMI for wealth.

You invest.

Market goes up and down.

But you keep going.

What Is Lump Sum?

A lump sum investment means investing a large amount at once into a mutual fund.

This usually happens when:

- You receive a bonus

- You sell property or gold

- You inherit money

- You’ve saved cash for years

Both SIP and lump sum are tools.

Neither is good or bad by default.

Why SIP vs Lump Sum Matters So Much in India

India is not a predictable country financially.

- Salaries come monthly

- Expenses are uncertain

- Parents depend on us

- Emergencies are common

Most people don’t realize this:

The best investment strategy is the one you can continue peacefully.

Indian Reality Check

- Market crashes happen (2008, 2020, 2022)

- Jobs are not guaranteed

- Medical emergencies can wipe savings

- Emotional decisions hurt returns more than bad funds

That’s why choosing between SIP vs lump sum in India is not about returns alone.

It’s about behavior, discipline, and mental comfort.

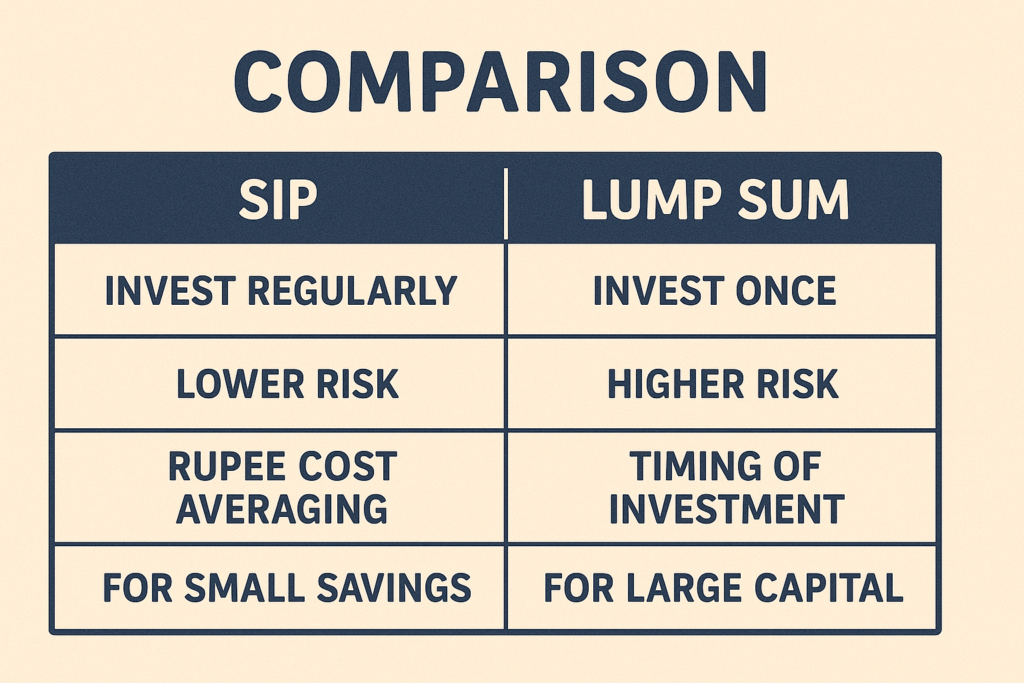

SIP vs Lump Sum India: Core Differences (Quick Table)

| Factor | SIP | Lump Sum |

|---|---|---|

| Investment style | Monthly | One-time |

| Risk level | Lower emotional risk | Higher timing risk |

| Best for | Salaried, beginners | Experienced, surplus cash |

| Market timing | Not required | Very important |

| Discipline | Automatic | Needs self-control |

| Stress level | Low | High |

| Ideal mindset | Long-term | Opportunistic |

Step-by-Step: How to Choose Between SIP and Lump Sum

Let’s make this practical.

Step 1: Check Your Income Style

- Fixed monthly salary? → SIP fits naturally

- Irregular income / windfall? → Lump sum may work

Step 2: Check Your Market Knowledge

Ask honestly:

- Do I understand market cycles?

- Can I stay calm during a 30% fall?

If not → SIP.

Step 3: Check Your Emotional Strength

Think about this…

If you invest ₹2 lakh today and market falls tomorrow—

Will you panic?

If yes → SIP.

Step 4: Combine Both (Smart Indians Do This)

Many experienced investors use:

- SIP for regular investing

- Lump sum during market corrections

This hybrid approach often works best.

SIP vs Lump Sum India: Real-Life Scenarios

Scenario 1: Young Professional (Age 25–35)

Anita earns ₹45,000/month in Bengaluru.

She saves ₹6,000 monthly.

Best choice: SIP

Why? Discipline > timing.

Scenario 2: Bonus or Inheritance

Rajesh received ₹5 lakh from land sale.

He doesn’t want to risk it all at once.

Smart move:

- Divide into 6–12 month SIP (STP route)

- Invest gradually

This reduces timing risk.

Scenario 3: Market Crash Opportunity

In March 2020, those who invested lump sum during panic saw huge gains.

But here’s the truth:

Only emotionally strong investors can do this.

Most people freeze.

SIP vs Lump Sum Returns: The Hidden Truth

Many YouTube videos show:

“Lump sum gives higher returns!”

That’s half-truth.

Reality:

- Lump sum works best when market timing is perfect

- SIP protects you when timing is wrong

Over 10–15 years:

- SIP and lump sum returns often become similar

- SIP wins on consistency

- Lump sum wins on opportunity

Common Mistakes Indians Make

Mistake 1: Stopping SIP During Market Falls

This destroys compounding.

Mistake 2: Investing Lump Sum Emotionally

“Everyone is investing, I should too.”

Mistake 3: Comparing One-Year Returns

Wealth is built over decades, not quarters.

Pro Tips Most People Don’t Tell You

- SIP during crashes is powerful

- Lump sum works best via STP

- Asset allocation matters more than method

- Behavior > strategy

SIP vs Lump Sum India: App Comparison (Tools)

| App | Best For | Pros | Cons |

|---|---|---|---|

| Groww | Beginners | Simple UI | Limited advisory |

| Zerodha Coin | DIY investors | Low cost | Learning curve |

| ET Money | Goal-based | Guidance | Premium upsell |

| Paytm Money | Convenience | Integrated app | UI clutter |

| Upstox | Active investors | Speed | Less hand-holding |

Tools, Apps & Resources

If you’re starting out, Groww and ET Money are beginner-friendly.

They simplify SIP setup, show goals clearly, and reduce decision fatigue.

For DIY investors, Zerodha Coin offers low-cost investing with full control.

This is what helped many first-time Indian investors stay consistent.

Emotional Indian Stories That Matter

Story 1: Middle-Class Discipline

Suresh started ₹2,000 SIP in 2012.

No big knowledge. No timing skills.

Just consistency.

Today, his corpus crossed ₹18 lakh.

Story 2: Lump Sum Regret

Amit invested ₹3 lakh in 2021 peak.

Panicked in 2022.

Exited at loss.

Not because lump sum is bad.

But because emotion was unprepared.

Final Thoughts: A Personal Note

If you take only one thing from this article, remember this:

The best investment is the one that lets you sleep peacefully.

SIP vs lump sum in India is not a battle.

It’s a choice based on your life.

Start small.

Stay consistent.

Grow patiently.

Wealth in India is built quietly—not loudly.

Internal & External Linking Suggestions

Internal Links

- SIP for Beginners in India

- Best Mutual Funds for Long-Term Wealth

- How to Start Investing with ₹500

- Monthly Budget Plan for Indian Families

External Authoritative Links

FAQs

SIP vs lump sum India—what is safer?

SIP is emotionally safer for most Indians.

Can I do both SIP and lump sum?

Yes. This is often the best approach.

Is SIP better for beginners in India?

Absolutely. It builds discipline.

When is lump sum better?

During market corrections or with surplus cash.

Does SIP give lower returns?

Not necessarily. Over long term, returns are competitive.

What is STP in mutual funds?

Systematic Transfer Plan—smart way to invest lump sum gradually.

Which is best for long-term wealth?

Consistency matters more than method.

Leave a Reply