Stock Market for Beginners in India (2026 Guide): Simple Basics for First-Time Investors

If you’ve ever looked at the stock market and felt,

“The stock market always felt confusing and out of reach.”

…you’re not alone.

Most Indians want to invest, but three things hold them back:

- fear of losing money

- confusion about how the market works

- no one to explain it in simple, real-life language

This guide solves all three.

You’re about to learn the stock market basics for beginners in India (2026) in a way that feels:

- simple

- human

- practical

- relatable

No jargon.

No complicated formulas.

No “expert kehte hain…” tone.

Just clear guidance, stories, Indian examples, and step-by-step help — exactly how someone would teach a friend.

Take a deep breath.

Let’s begin your investing journey.

🟦 What Exactly Is the Stock Market? (Explained Like You’re 18)

Imagine you and your friend open a chai shop.

Total investment needed: ₹1,00,000.

You put ₹60,000. He puts ₹40,000.

You both now own a share in the business.

If the chai shop grows → your share value grows.

If it fails → your share drops.

The stock market is simply this — at a bigger scale.

Companies like:

- Reliance

- Infosys

- Tata Motors

- HDFC Bank

- Zomato

…sell small pieces of their business to the public.

These pieces are called shares (stocks).

When you buy a stock, you own a tiny part of that company.

If the company performs well →

📈 Your wealth grows.

If the company performs poorly →

📉 Your stock falls.

That’s the heart of the stock market.

Simple, right?

🟦 Why Indians Should Start Investing in 2026 — Not Later

A surprising truth:

👉 You don’t get rich by saving.

You get rich by investing.

India’s inflation averages 5–7% every year.

This means:

- Your savings account grows: 2–3%

- Your expenses grow: 7%

- Your wealth → falls behind.

But the Indian stock market, historically:

📈 12–15% annual average returns (over long term)

📈 Strong GDP growth ahead

📈 Growing middle-class investor base

2026 is one of the best years to start investing because:

- Young India (18–35 age group) is investing more than ever

- Fintech apps made investing easy

- SIPs make stock investing simple

- India is becoming a global economic powerhouse

In short:

If you start now, the future version of you will thank you.

🟦 How the Stock Market Works in India (2026 Version)

There are only 2 main stock exchanges:

- BSE (Bombay Stock Exchange)

- NSE (National Stock Exchange)

And 3 main players:

1. The Company

Needs money → sells shares.

2. The Investors (You)

Buy shares → expect returns.

3. SEBI

India’s market watchdog.

Ensures safety, transparency, and fairness.

Everything happens through:

🟩 Trading apps

🟩 Stock exchanges

🟩 Brokers

🟩 Banks

🟩 Depositories

You don’t need to deal with any complexity —

apps automate everything.

🟦 Step-by-Step: How Beginners Should Start Investing (2026)

This is the simplest 5-step roadmap for first-time investors in India.

🟦 Step 1 — Open a Demat + Trading Account

Recommended apps:

- Groww

- Upstox

- Zerodha

- Angel One

- HDFC Sky

Choose based on:

- easy interface

- low fees

- good customer support

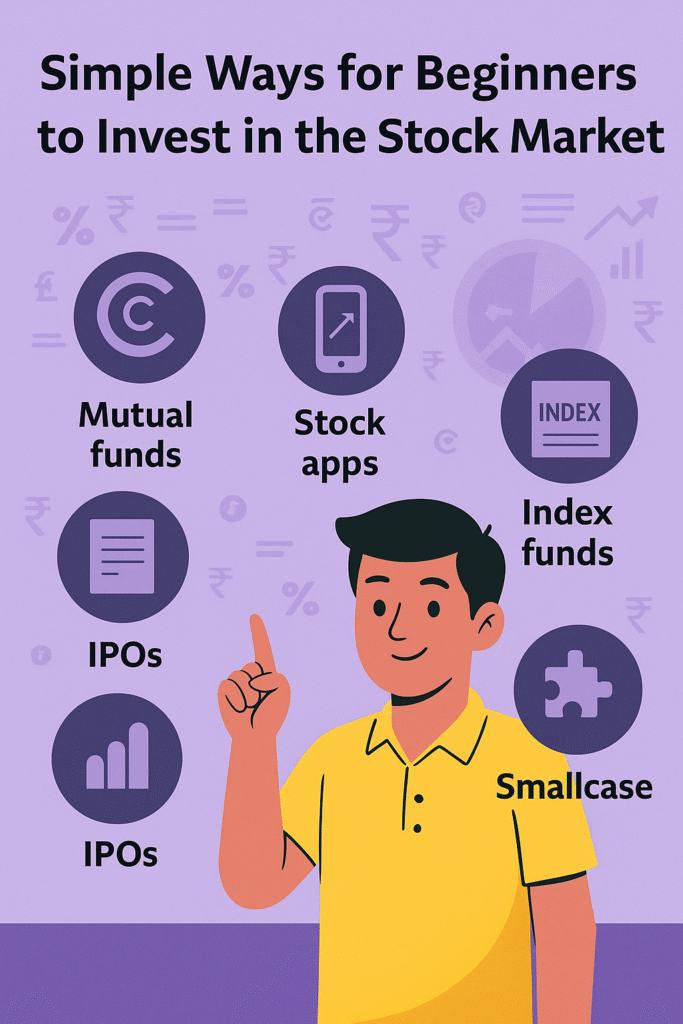

🟦 Step 2 — Start With the Safest Beginner-Friendly Investments

Beginners should never start with:

❌ Day trading

❌ Options trading

❌ Penny stocks

❌ Hot tips from relatives

❌ “Guaranteed” Telegram signals

Instead, begin with:

✔️ Index Funds

(Nifty 50, Sensex)

✔️ Blue-Chip Stocks

(Reliance, TCS, HDFC Bank)

✔️ ETFs

(Nifty Next 50, Bank Nifty ETF)

✔️ SIP in Equity Mutual Funds

This reduces risk, builds confidence, and grows wealth steadily.

🟦 Step 3 — Invest Small (But Consistently)

You don’t need ₹10,000 or ₹50,000.

Start with:

- ₹100 SIP

- ₹500 SIP

- ₹1,000 SIP

Small steps → big results.

If you invest:

| Monthly SIP | 12% return | After 20 years |

|---|---|---|

| ₹1,000 | ₹1.1 lakh | ₹9.9 lakh |

| ₹3,000 | ₹3.3 lakh | ₹29.8 lakh |

| ₹5,000 | ₹5.5 lakh | ₹49.7 lakh |

Consistency beats intelligence.

🟦 Step 4 — Understand the Two Types of Returns

1. Capital Appreciation

Stock price rises → profit.

2. Dividends

Company shares profit with you → money credited automatically.

🟦 Step 5 — Hold Long-Term

No one gets rich by buying and selling daily.

But everyone who held good companies long-term became wealthy.

Examples:

- ₹10,000 in Infosys in 1993 → ₹3+ crores today

- ₹10,000 in Asian Paints in 1990 → ₹1.8+ crores today

The lesson?

👉 Time in the market > Timing the market.

🟦 Common Mistakes Beginners Must Avoid (Very Important)

❌ Checking stock prices daily

❌ Buying because influencers said so

❌ No emergency fund

❌ No diversification

❌ High expectations

❌ Selling during panic

❌ Buying during hype

Remember:

👉 The market rewards patience, not panic.

🟦 Simple Stock Market Terms (Explained Without Jargon)

Stock — A piece of a company

Portfolio — All your investments

Broker — App you use to buy stocks

IPO — Company’s first time selling shares

Bull Market — Prices rising

Bear Market — Prices falling

Market Cap — Company size

Blue Chip — Big, stable companies

🟦 Emotional Side of Investing — The Part No One Talks About

Investing isn’t only about numbers.

It’s about:

- fear

- greed

- confidence

- patience

When the market falls, your brain screams:

“SELL NOW! SAVE YOUR MONEY!”

But long-term investors stay calm.

Because they know:

👉 Short-term noise doesn’t matter.

Long-term growth does.

🟦 Soft Affiliate Recommendation Section (Natural, Ethical)

If you want a smooth beginner experience, these tools genuinely help:

Investment Apps (Beginner-Friendly):

- Groww

- Zerodha Kite

- HDFC Sky

- ET Money

Research Tools:

- TickerTape

- Screener

- Trendlyne

Learning Resources:

- Varsity by Zerodha (free)

- YouTube: CA Rachana, Pranjal Kamra

- Books:

- The Little Book of Common Sense Investing

- Coffee Can Investing

- The Psychology of Money

No pressure.

Just options that make your journey easier.

🟦 Internal Linking Suggestions

Inside your blog, link to:

🔗 Pillar Page: Stock Market

Slug: /category/stock-market/

🔗 Suggested Cluster Posts:

- How to Pick Winning Stocks in India

- Stock SIP vs Mutual Fund SIP

- Best Long-Term Stocks for Beginners (2026)

- Stock Market Terms Every Indian Should Know

- How to Avoid Stock Market Scams

🟦 FAQs

1. How can I start investing in stocks in India (2026)?

Open a Demat account on Groww, Zerodha, Upstox, or HDFC Sky. Start with index funds or blue-chip stocks.

2. How much money do I need to start investing?

Even ₹100–₹500 a month is enough through SIPs.

3. Is the stock market safe for beginners?

Yes, if you avoid risky trading and stick to long-term investing.

4. Which stocks are best for beginners?

Large-cap, stable companies like Reliance, TCS, HDFC Bank, Asian Paints.

5. Should I trade daily?

No. Beginners should avoid day trading completely.

6. How long should I hold stocks?

Minimum 5–10 years for meaningful growth.

7. What is the safest way for beginners to invest?

Index funds + SIPs + blue-chip stocks.

Leave a Reply