Let’s start with a small story you’ll probably relate to.

One evening, Arjun — a 27-year-old working professional from Chennai — sat at his desk staring at the Groww app.

The screen looked like a maze of confusing names…

Blue chip. Mid-cap. IPO. Penny stocks.

“Why are there so many types of stocks?” he muttered, feeling lost.

If you’ve ever opened Zerodha, Upstox, ET Money, or even scrolled through finance videos on Instagram, you’ve surely felt this too.

Here’s the truth…

Most Indians jump into the stock market without understanding the types of stocks in India — and that single gap decides whether they grow wealth or lose sleep.

But it doesn’t have to be confusing.

This guide will break everything down like a friendly conversation.

Simple language.

Real stories.

Practical steps.

No fluff.

Just pure clarity — the kind you wish your college textbooks had.

So take a deep breath.

Let’s make the Indian stock market finally make sense.

Understanding the Topic — Types of Stocks in India (Explained Simply)

Before you buy a single share, you must understand what “type” it belongs to.

Different stocks behave differently — like people.

Some are calm and stable.

Some are aggressive and unpredictable.

Some grow slowly but surely.

Some can double fast or disappear overnight.

Think of it like an Indian family:

- Your dad: stable, reliable → Blue-chip stocks

- Your cousin who started a startup: fast-growing → Growth stocks

- Your uncle who loves saving tax: careful → Value stocks

- Your younger sibling who experiments randomly → Penny stocks

Understanding these categories helps you:

- reduce risk

- pick the right investments

- set clear expectations

- avoid disasters

Here’s what most people don’t realize:

👉 The wrong stock type ruins wealth even if the company looks “popular”.

👉 The right stock type builds wealth even if you invest small.

Let’s break everything down in a way no textbook ever will.

Why This Topic Matters

Here’s a relatable situation:

Your WhatsApp family group is filled with hot stock tips.

Your office colleague tells you, “Bro, buy small-caps, they give massive returns!”

Your uncle says, “Beta, stick to TCS, Infosys — safe stocks only.”

Everyone means well, but their advice is based on their risk level, not yours.

Why understanding types of stocks matters for Indians:

- We invest savings carefully — because every rupee matters

- Most families are first-generation investors

- Nobody teaches stock market basics in school or college

- Indians prefer safety but want high returns

- Only 8–10% of Indians invest in stocks — due to confusion

Once you understand how each stock type works, you’ll invest with confidence — not fear, not gambling, not guesswork.

Step-by-Step Guide — Types of Stocks in India Explained

Below is a simple, practical guide covering all major stock categories in India.

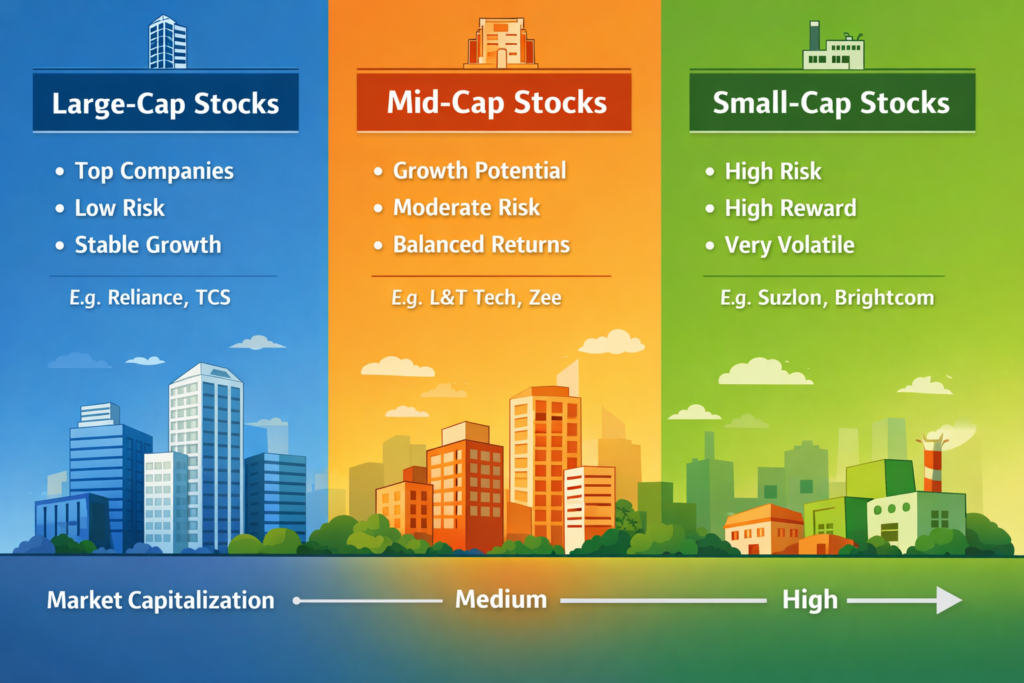

1. Based on Market Capitalization (Large, Mid, Small Cap)

These are SEBI-defined categories.

Large-Cap Stocks

- Big companies

- Stable

- Lower risk

- Slow but steady growth

Examples:

Reliance, TCS, Infosys, HDFC Bank, ITC, Asian Paints

Ideal For:

Beginners, risk-averse investors, long-term stability.

Mid-Cap Stocks

- Fast-growing

- Moderate risk

- Potential multi-baggers

Examples:

Zee Entertainment, L&T Technology, Max Healthcare

Ideal For:

People who want growth + manageable risk.

Small-Cap Stocks

- High-risk, high-return

- Volatile

- Not suitable for absolute beginners

Examples:

Brightcom Group, Suzlon (historical volatility)

Ideal For:

Investors with high risk appetite.

Comparison Table

| Type | Risk | Return Potential | Who Should Invest | Indian Example |

| Large Cap | Low | Moderate | Everyone | TCS |

| Mid Cap | Medium | High | Growth seekers | L&T Tech |

| Small Cap | High | Very High | High-risk takers | Suzlon |

2. Based on Investment Style

Growth Stocks

- Fast-growing companies

- Higher valuations

- Higher returns

Example:

DMart, Zomato, Nykaa, Titan

Value Stocks

- Undervalued companies

- More stable

- Long-term wealth generators

Example:

ITC earlier, Coal India, ONGC

Dividend Stocks

- Companies sharing profit regularly

- Ideal for passive income

Examples:

Hindustan Unilever (HUL), ITC, Coal India

Table: Growth vs Value vs Dividend

| Type | Strength | Weakness | Best For |

| Growth | High returns | Expensive | Young investors |

| Value | Stability | Slow | Long-term builders |

| Dividend | Monthly/annual income | Lower appreciation | Retirees, families |

3. Based on Ownership

Common Shares

Most popular. You get voting rights.

Preference Shares

No voting rights, but priority dividends.

4. Based on Risk Level

Blue-Chip Stocks

Highly reliable.

Example: HDFC Bank, Infosys.

Penny Stocks

Very low price. Very risky.

Example: Stocks under ₹10–₹20.

5. Based on Sector

- IT stocks (Infosys, TCS)

- Banking stocks (HDFC Bank, SBI)

- FMCG stocks (HUL, Nestlé)

- Automobile stocks (Tata Motors, Mahindra)

- Pharma stocks (Cipla, Sun Pharma)

Tips, Mistakes & Pro Secrets

Common Mistakes Indians Make

❌ Buying stocks because someone else recommended

❌ Not checking the type of stock

❌ Expecting quick returns

❌ Investing all money into one stock

❌ Blindly following YouTube “experts”

Pro Secrets

💡 1. Always mix large + mid + small caps.

A balanced portfolio reduces risk drastically.

💡 2. Never buy a small-cap during market panic.

They fall the fastest.

💡 3. Start with 60% large-cap if you’re a beginner.

💡 4. Use tools like Groww, Zerodha, Paytm Money to research before buying.

Comparison Section — Stocks vs ETFs vs Mutual Funds

| Feature | Stocks | ETFs | Mutual Funds |

| Risk | High | Medium | Low-Medium |

| Flexibility | High | Medium | Low |

| Best For | Experienced | Balanced | Beginners |

| Indian Example | Reliance | Nifty50 ETF | SBI Bluechip Fund |

Real-Life Stories & Scenarios

Story 1: The Student Investor

Riya, a college student from Pune, started with ₹500 through Zerodha.

She invested in large-cap stocks like ITC and Infosys.

Slow growth, but steady.

In three years, her SIP grew into something meaningful — and she gained priceless confidence.

Story 2: The Corporate Father

Arvind, a 38-year-old working father, invested in dividend stocks to generate passive income for school fees.

HUL and ITC dividends created monthly income he didn’t expect.

Story 3: The High-Risk Trader

Karan jumped into penny stocks after watching YouTube hype.

Lost ₹40,000 in two weeks.

Only later he learned why knowing stock types matters more than hype.

Tools, Apps & Resources

Here’s what genuinely helped me and thousands of Indian investors.

Not selling — just sharing what works.

1. Groww (Beginner Friendly)

- Clean app

- Simple UI

- Easy to understand stock categories

Best For: Students, beginners

Why I Recommend: Stress-free starting point.

2. Zerodha (Best Overall)

- India’s most trusted broker

- Advanced charts

- Perfect for research

Best For: Professionals

Why I Recommend: Low brokerage + reliability.

3. ET Money (For portfolios)

- Great for managing stocks + mutual funds together

- Shows risk level clearly

Pros/Cons Table

| Platform | Pros | Cons |

| Groww | Simple UI | Limited advanced charts |

| Zerodha | Most trusted | Slight learning curve |

| ET Money | Great portfolio tools | Not for active traders |

Final Thoughts — A Warm Note

If you’ve reached here, you’ve already done something 90% of Indians never do —

You educated yourself before investing.

That alone makes you a smarter investor.

Remember:

- You don’t need to choose the perfect stock

- You just need to choose the right type

- Be patient

- Stay consistent

- And invest with awareness, not emotion

Your financial journey is uniquely yours —

and you deserve clarity, confidence, and peace.

When you’re ready, continue to our next guide on building your first Indian stock portfolio.

You’ve got this.

Internal & External Linking Suggestions

Internal Links

- Beginner Guide to Stock Market India

- How to Build a Stock Portfolio

- Best Demat Accounts in India

- Mutual Funds vs Stocks in India

Leave a Reply